On September 22, 2014, South Korean President Park Geun-hye and Canadian Prime Minister Stephen Harper signed the Canada-Korea Free Trade Agreement (CKFTA), cementing their commitment to greater bilateral economic integration. The completion of the CKFTA signifies a major milestone, not only in Canada-Korea relations, but also in Canada’s engagement in the Asia Pacific region.

The CKFTA is considered a high-standard comprehensive preferential trade agreement, covering areas of trade in goods and services; two-way investment; government procurement; intellectual property; environment and labour standards; and dispute settlement. When the agreement is fully implemented, it will reduce South Korea’s tariffs by 98.2% and Canada’s tariffs by 97.8%. In addition, the removal of non-tariff barriers and streamlining of regulations ensures that Canadian and Korean businesses receive preferential treatment and access in each other’s respective markets. This treatment and access is on par with, or in some aspects better than, friendly competitors who recently completed free trade agreements with South Korea—the U.S., the E.U., and Australia. It also has the potential to significantly boost trade and investment flows between our two countries, which have underperformed in recent years.

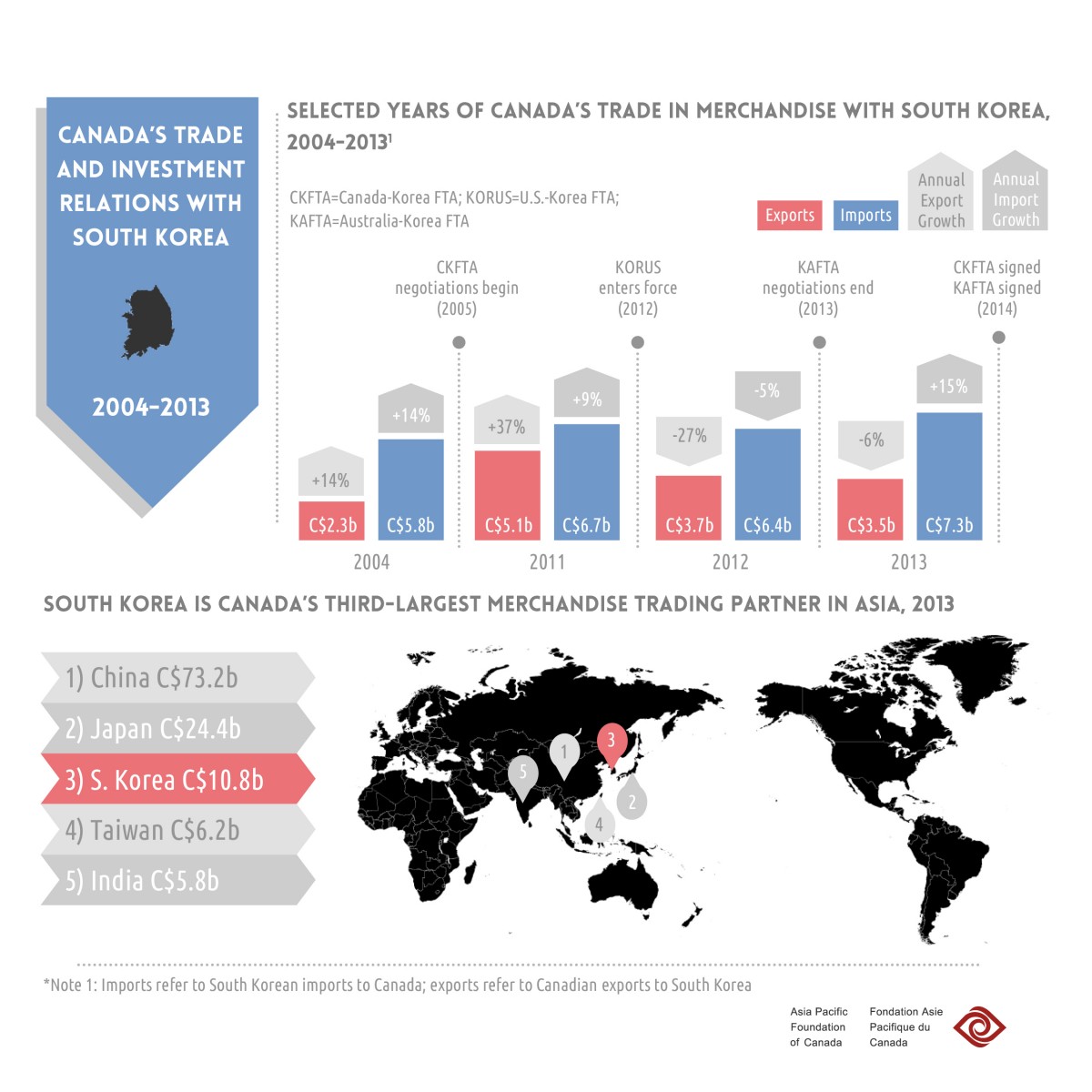

In 2013, two-way trade in merchandise amounted to C$10.5 billion, making South Korea our seventh-largest global trading partner in merchandise and the third-largest in the Asia Pacific. However, growth in our merchandise trade diminished significantly in 2012, the same time the U.S.-Korea Free Trade Agreement (KORUS) entered into force. From 2011 to 2012, the value of Canadian merchandise exports to South Korea and South Korean merchandise imports to Canada declined by 27.1% and 4.5% respectively. In 2013, while the value of South Korean imports bounced back to higher than 2011 levels, the value of Canadian exports further decreased by 5.8%. This has created a 2013 trade balance deficit of C$3.8 billion, the largest ever between Canada and South Korea (given the availability of data from Industry Canada).

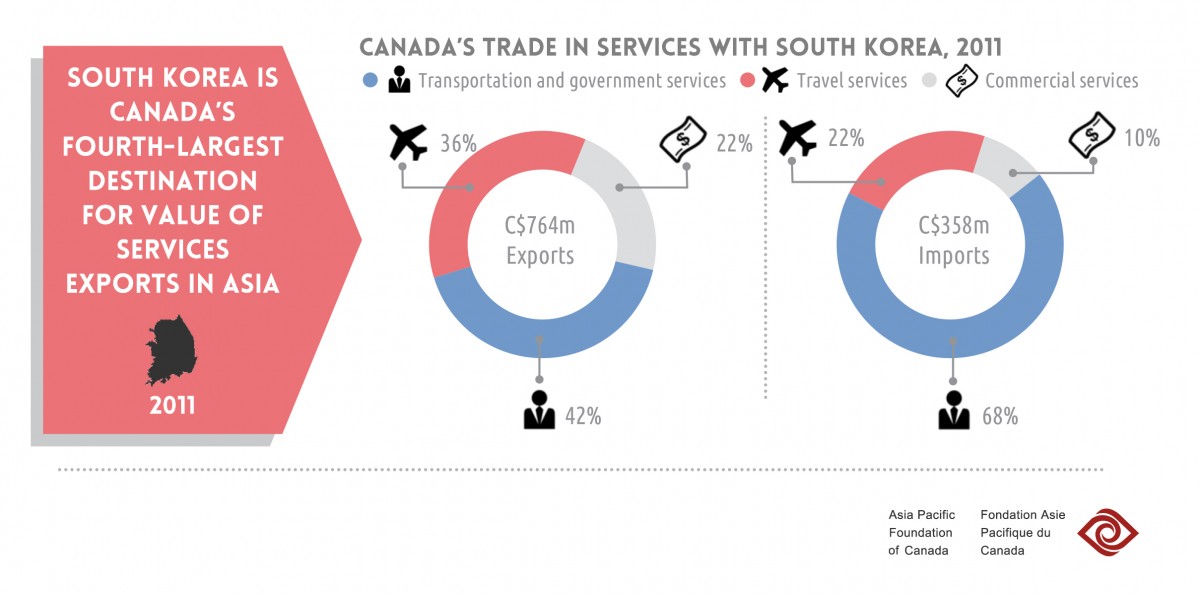

In 2011, exports and imports of trade in services totalled C$1.1 billion, making South Korea our 20th-largest trading partner in services. The compound annual growth rate (CAGR)—which expresses an annual steady growth rate over a period of time—from 2004 to 2011 was only 1.0% and most of this trade was generated from transport (i.e. revenues and expenses from goods or people transported internationally) and government services (i.e. expenses from government officials and military activities abroad). Given that both our economies are service-driven, there is a lot of potential to bolster trade in services—particularly in commercial services (i.e. services dealing with information and communication technologies, management, insurance, etc.) and travel services (i.e. individuals’ expenses in a foreign country: food, accommodation, recreation, etc.).

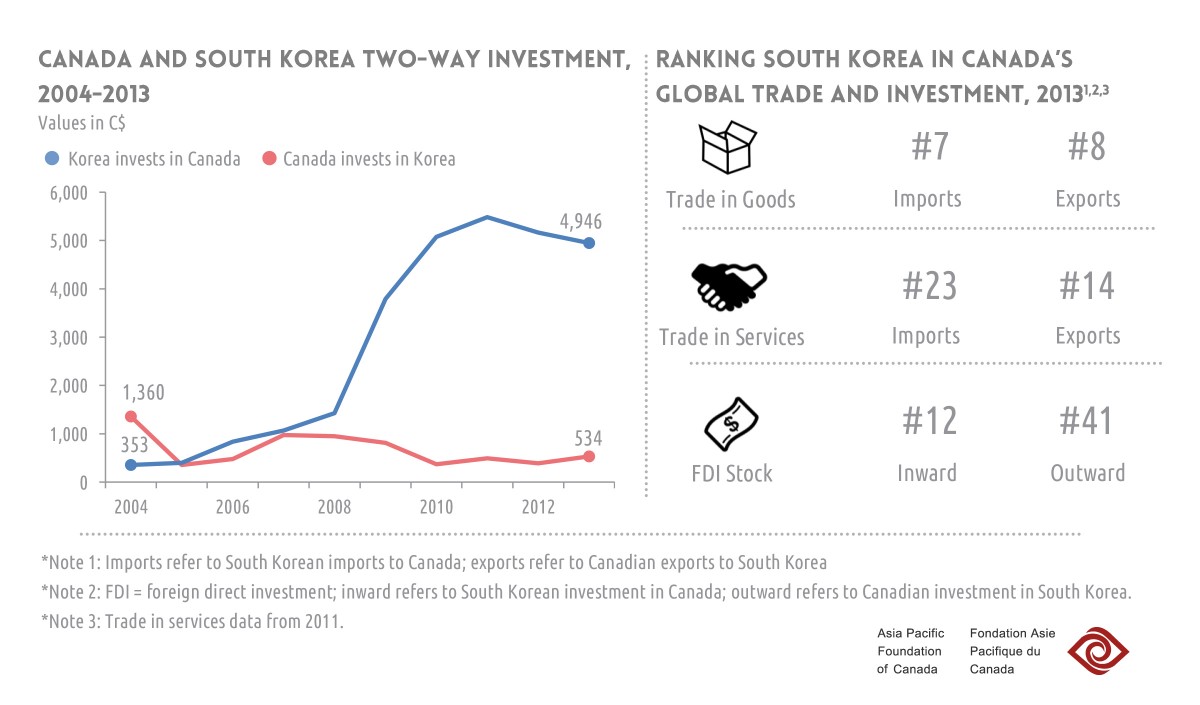

Investment flows between Canada and South Korea also have room to improve. In 2013, two-way foreign direct investment (FDI) stock—the total value of foreign assets and investments in a host country—equaled C$5.5 billion, with Canadian investment in South Korea only accounting for C$534 million of the total investments. When compared to Canadian investment in other Organization for Economic Co-operation and Development (OECD) economies in the same year, our FDI stock in South Korea ranked sixth lowest among OECD economies receiving Canadian investment and 41st among all of Canada’s outward investment partners. Although this could be attributed to a higher FDI regulatory restrictiveness in South Korea compared to other OECD members (see OECD index), it also represents a failure of Canadian businesses to successfully penetrate the South Korean market on a large scale compared to investors from other countries.

The CKFTA can act as a catalyst to boost our trade and investment relations with South Korea. While the negotiated text maintains protectionism in some key sectors (Canada’s supply management in the chicken and dairy industries and South Korea’s rice and ginseng industries), duties for contentious areas, such as Korean imports of beef and Canadian imports of automobiles, are being phased out through drawn out timelines. That being said, it is only when the agreement enters force that this preferential access will bear fruit for the Canadian economy.

Canada and South Korea are entering the final stretch for the CKFTA to become a reality, with the only remaining hurdle being the ratification of the agreement. Currently, with all major political parties except for the Green Party showing support for the FTA, the Parliament of Canada is on pace to read the bill that would ratify the agreement (C-41) for the third time—the last time before it is voted on. South Korea’s National Assembly has yet to give approval due to a backlog of other pertinent issues—including the ratification of the Australia-Korea Free Trade Agreement (KAFTA), which was signed in April 2014.

Even if the agreement were to enter force in early 2015, it would be up to Canadian businesses and investors to reap the gains achieved in the FTA. Trade promotion organizations and agencies, such as Canada’s trade commissioners and Export Development Canada, will be essential in educating Canadian businesses—especially small and medium-sized enterprises (SMEs)—on how to fully utilize the agreement to their advantage. This means that although the negotiation marathon is almost complete, the real race to enhance Canada-Korea trade and investment relations is only beginning.