The Takeaway

Indonesia, chair of the Association of Southeast Asian Nations (ASEAN) for 2023, delivered the first-ever ASEAN leaders’ declaration on developing a regional electric vehicle (EV) ecosystem during the 42nd ASEAN Summit held May 9–11 in Labuan Bajo, Indonesia. The regional EV ecosystem goal demonstrates political will towards developing EVs, bolsters regional economic integration, and creates an enabling environment for investment in developing the EV supply chain, especially in Indonesia, which aims to become a global battery and EV manufacturing hub.

In Brief

Indonesia hosted the 42nd ASEAN Summit under the theme, “ASEAN Matters: Epicentrum of Growth.” The theme underscores strengthening ASEAN’s capability as the global centre of economic growth and its integral role in maintaining peace and stability in the Asia Pacific region. A key highlight of the summit was the leaders’ declaration on EV ecosystem development. All members signed onto the statement and agreed to build an EV ecosystem that supports EV adoption and the improvement of the EV industry in ASEAN member states, reinforcing the region’s reputation as a global EV manufacturing hub.

Leaders encouraged the harmonization of regional standards for the EV ecosystem to ensure interoperability and facilitate cross-border trade and mobility and underscored the importance of training and certification to build human capital. They also agreed to work together to improve infrastructure; create an enabling business environment to attract investments; promote greater private sector engagement and awareness of EVs to consumers; improve the participation of micro, small, and medium enterprises; and collaborate on research and development to strengthen the regional supply chain.

Implications

ASEAN’s big push to become a global electric vehicle hub is timely for Indonesia as the country is at the forefront of EV development in the region. Since assuming the chairmanship of ASEAN 2023, Indonesian President Joko Widodo has been adamant about Indonesia capitalizing on ASEAN’s expected robust economic growth: the region’s collective GDP is expected to grow 4.7 per in 2023, nearly doubling the global average of 2.7 per cent GDP growth. In fact, at the ASEAN Summit, Widodo stated that the EV ecosystem will be an important part of the global supply chain and that developing a downstream EV industry is crucial.

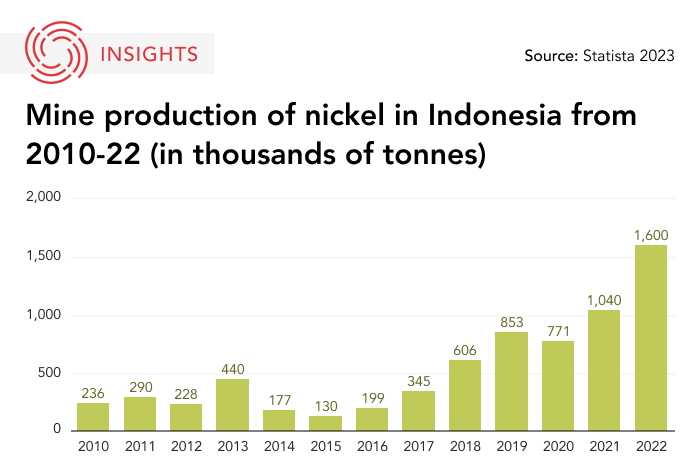

The declaration emphasized the importance of harnessing member states’ comparative advantages in various stages of the EV supply chain. Indonesia, for one, has much to offer the EV ecosystem: the country holds the world’s largest nickel reserves and produces more nickel than any other country. Indonesia is also the second-largest global producer of cobalt.

ASEAN chair Jokowi’s focus on downstream industry development is perfectly aligned with Indonesia’s own strategic plan on coal and mineral commodities to advance its downstream industries. Launched in 2021, the grand strategy also included a nickel “roadmap” for 2021-45, which specifies its objectives to ensure availability of reserves, improve purification processes, and develop manufacturing capabilities.

Indonesia’s nickel strategy aims to catapult the country from a heavy resource-based exporter to a value-added commodity exporter and, in the process, become a leading manufacturing hub for batteries and EV automobiles. EV adoption and development are also part of the country’s strategy on energy transition.

Indonesia is already attracting investments from global companies such as Hyundai, Toyota, BYD, Wuling, and CATL to set up manufacturing plants, smelters, and refineries amid Indonesia’s ongoing export ban on nickel ores. But these investments are meagre compared to those flowing into China, Europe, and the U.S., despite Indonesia’s nickel reserve advantage.

Experts and Bloomberg analysis have pointed out two big challenges that Indonesia must overcome to seize the EV opportunity: first is its heavy dependence on coal and gas for electricity generation and inadequate policies on renewable energy procurement for companies. As a result, the country’s battery production will have a large environmental footprint — a disincentive for companies looking to minimize emissions. Second is low domestic EV adoption, resulting in low domestic demand for EVs and batteries which, again, disincentivizes manufacturers to set up production facilities in the country.

What's Next:

- Implementation of declaration

ASEAN leaders have tasked the ASEAN Economic Community (AEC), a working body responsible for managing ASEAN’s goal of economic integration among member states, to oversee the implementation of the declaration. AEC will provide guidance on the formulation of a comprehensive regional strategy and will lead the overall co-ordination of the regional ecosystem vehicle agenda.

- Critical minerals ban

In its quest to develop a downstream processing and refining industry, Indonesia took a bold step by banning nickel ore exports in January 2020. The ban remains in place, despite the WTO’s ruling against the measure. In December 2022, Jokowi announced another export ban — this time on bauxite, effective June 2023. With EV ambitions soaring high, it’s plausible that further export bans could be imposed on critical minerals, such as tin, cobalt, and copper.

• Produced by CAST's Southeast Asia team: Stephanie Lee (Program Manager); Alberto Iskandar (Analyst); and Saima Islam (Analyst).