The Chinese government has recently declared itself in favor of crowdfunding, citing it as an important tool for bolstering the nation’s economy. In a recent meeting with Chinese leaders in education, science and technology, Premier Li said that, “New ideas like crowdsourcing and crowdfunding will be promoted to bring more social forces into play.” The Chinese stamp of approval goes further than simple declarations. A document by the State Council, published on the central government’s website, describes crowdfunding as a “useful complement” to traditional equity financing, especially when it comes to helping smaller companies. Still, bearing in mind the high potential for fraudulent practices, the central government is mindful of developing the system in conjunction with investors’ rights protection and financial risk minimization. Furthermore, draft regulations on equity-based crowdfunding have recently been published by the China Securities Association, signaling that the government is doing more than issuing a soft statement of support. Still, with the advent of online crowdfunding, offline crowdfunding has also seen interesting developments and not surprisingly, with “Chinese characteristics.”

Online Crowdfunding: Success Even Within a Restrictive Regulatory Environment

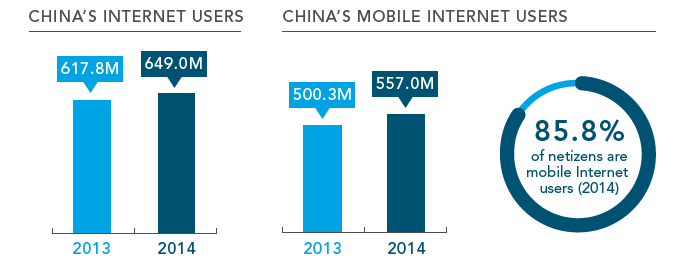

It comes as no surprise that online crowdfunding has taken off quickly. As of the end of 2014, China counted some 649 million Internet users, 31.17 million more than the year before. Furthermore, mobile Internet users amounted to 557 million users in 2014. [1] Hundreds of millions of active netizens represents a huge potential source of funds and projects alike.

The current legal regime, however, does not allow online platforms to directly solicit money from individuals. The two laws in play are the Securities Law (hereafter referred to as Securities) and the Banning on Illegal Financing Agencies and Activities (hereafter referred to as Banning), issued by the State Council in 1998. The definition of direct financing activities in Securities is quite narrow and therefore not flexible enough to encompass modern financing methods. Article 10 of Securities prohibits any institution or individual from issuing securities openly without legal approval, and from issuing securities for indefinite objectives. Articles 3 and 4 of Banning states that intermediaries engaged in traditional commercial banking activities (like deposit processing and loan-lending) without specific approval by the authorities, or those soliciting funding from indefinite crowds, are deemed to be illegal financing activities. As some commentators have stated, the central government is afraid that crowdfunding could be utilized as a pyramid scheme.

What is crowdfunding? Crowdfunding is a form of microfinancing that has been gaining popularity since the early 2000’s. Notable online platforms such as Kickstarter, gofundme and Indiegogo have helped countless projects achieve funding goals by accumulating small contributions from the masses.With such restrictive regulations, how do big e-commerce firms like JD.com, Tencent and Alibaba still manage to reach these hundreds of millions of netizens and achieve crowdfunding success? They do so by employing indirect techniques, creative means of side-stepping current regulation. Successful schemes, like Alibaba’s Yu Le Bao scheme, a crowdfunding vehicle aimed at raising money for movie projects, stress that they are very different from the traditional crowdfunding model. For instance, they offer an interest rate of seven per cent on investments, making it more like an insurance and wealth management product. Tencent’s crowdfunding platform allowed a Chinese non-profit for disabled children, La La Shou, to raise 50,000 CNY (a little over C$10,000) in just two months. Since it could not ask netizens directly for money, it encouraged people to retweet a given message, where each retweet earned La La Shou around twelve cents (CAD) donated by Tencent’s charity foundation. It remains to be seen what effect the new regulations will have on the current regime and, more importantly, if they will ease the way for the proliferation of online crowdfunding platforms.

Offline Crowdfunding: “Chinese Characteristics” Come Strongly into Play

One of the more interesting crowdfunding developments in China is the development of “offline crowdfunding.” With some investors in China preferring a fundraising method with more personal contact, offline options that allow funders to know each other on a personal level before investing in a common project have sprung up across the country. A notable example of crowdfunding with “Chinese characteristics” is the 1898 café in Beijing (named after the year Beijing University was founded), one of the most successful crowdfunding café’s in China.

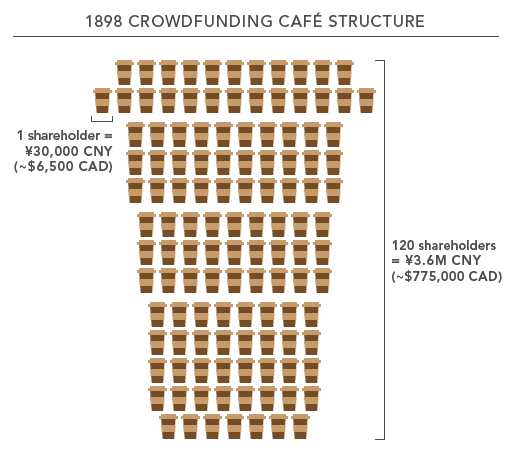

Founded by entrepreneur Yang Yong, a Peking University alumna, the café has 120 “shareholders,” more like investors, who each contributed 30,000 CNY (nearly C$6,500) to open the café. In return for their contribution, each person gets an expense card of the same value that they can use to redeem food and services from the café. Along with being a bona fide café, the location is also meant to serve as a pseudo innovation hub by providing entrepreneurs and investors with a space to meet and candidly interact with friends of other shareholders. Crowdfunding cafés such as 1898 sometimes mandate shareholders to hold events and mixers to help the group expand its face-to-face connections.

In this model, the “shareholder” encompasses three roles in one: that of investor, operator and consumer. The main goal of the crowdfunding café is not to turn a profit; the capital contributed at the beginning should be enough to keep the café running for at least three years without a single paying customer. Only then, after this prescribed period, will the café exist long enough to serve its purpose as a meeting hub for potential collaborations between innovators and investors.

What brings this closer to home in Canada is the fact that a crowdfunding café has recently opened in Metro Vancouver. Located in the Vancouver suburb of Richmond, Café 1029, whose name is an ode to the original 1898 café, boasts a similar structure, as well as a similar goal. 1029 has a hundred initial “shareholders” who each contributed C$10,000 to purchase and run the coffee shop. It remains to be seen how successful the Chinese approach to crowdfunding will be on Canadian soil.

As the year closes, China is on the cusp of its new five-year plan (2016-2020). As the nation aims to become a more robust service economy with a more moderate 6.5% annual growth rate, it remains to be seen what role crowdfunding and its regulation will play in the central government’s plans to fulfill its new economic goals.

[1] China Internet Network Information Center (CINIC), 35th report, http://www1.cnnic.cn/IDR/ReportDownloads/201507/P020150720486421654597.pdf