The Takeaway

On May 19, G7 leaders reaffirmed their commitment to co-ordinated sanctions on Russia. However, in recent months, G7 member Japan has increased its imports of low-cost Russian seafood, which runs counter to the bloc’s goal of economically isolating Russia — and adds insult to injury for seafood exporters in Atlantic Canada already reeling from declining demand from the U.S. Tokyo remains steadfast in continuing to import some Russian products, arguing it is a necessary measure to combat food insecurity and record-high consumer inflation rates.

In Brief

As a result of Russia’s invasion of Ukraine in March 2022, G7 leaders imposed sanctions, import bans, and other measures against Moscow, in the process reducing the bloc’s reliance on Russian goods and energy. But some G7 countries have exempted certain Russian exports – including liquefied natural gas (LNG) and marine products – from these measures, arguing domestic necessity. Japan, for one, relies heavily on these two imports from Russia to offset its energy and food needs.

Tokyo did revoke Russia’s preferential trade status, thereby raising tariffs on Russian imports. But according to the Japanese Ministry of Finance, Japan imported C$1.55 billion (155.2 billion yen) worth of marine products from Russia in 2022, a 12.9 per cent increase over 2021, and a record high since 1992. Japan harbours concerns over domestic food security and high inflation and appears willing to continue importing cheap Russian products even if it elicits groans from G7 members and frustrates some Canadian politicians.

Some Atlantic Canadian politicians have claimed, for example, that “aggressive Russian dumping” of cheap snow crab has made Canadian products less competitive on the Japanese market — especially in 2022 when Canadian crab prices were set at a record high of C$7.60 per pound. Even as Newfoundland and Labrador slashes its crab prices to C$2.20 per pound (with similar low prices seen in New Brunswick, Nova Scotia, and Quebec), it’s unlikely that Japan will pivot from Russia and drastically increase its Canadian imports during the current 2023 season.

Implications

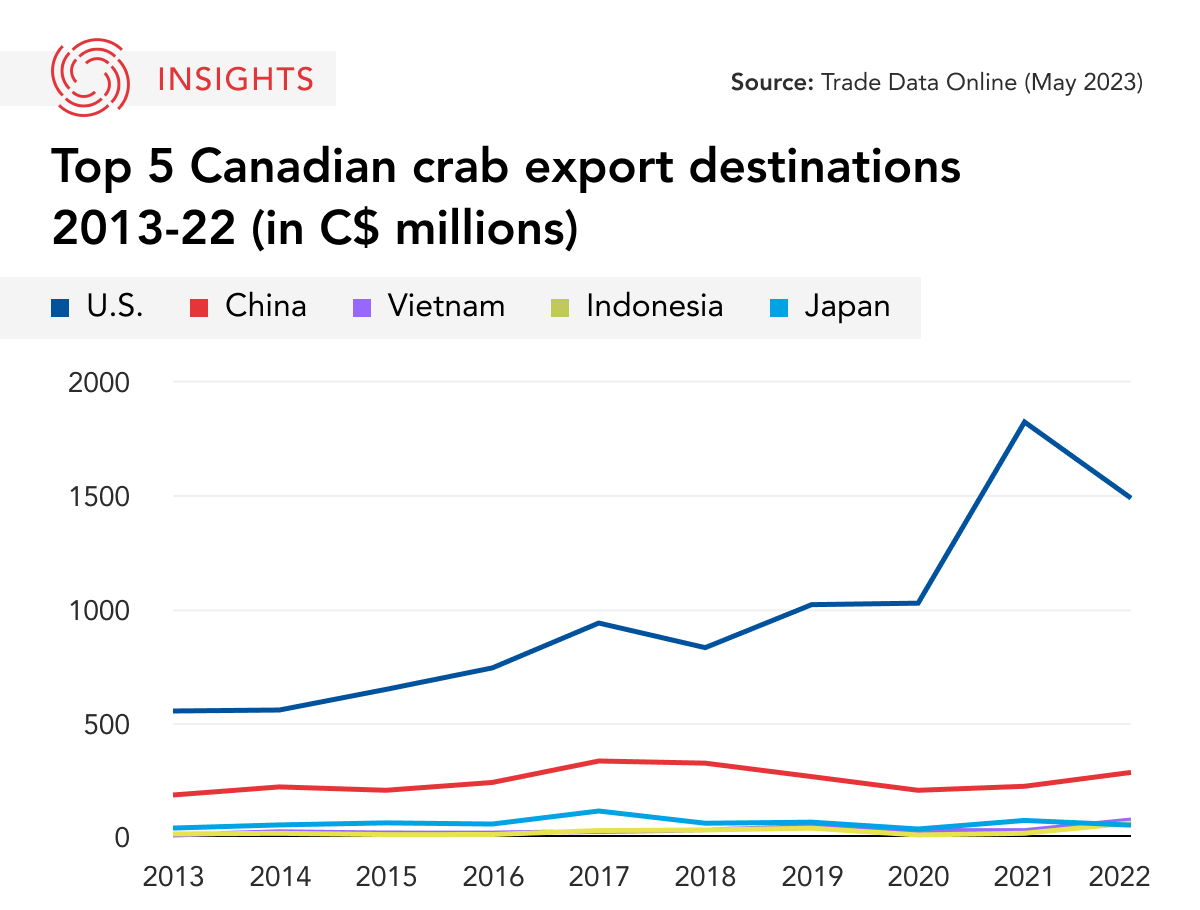

Canadian fisheries are suffering from sluggish sales of snow crab — a typically lucrative business in Atlantic Canada — mostly due to rising global food prices, high global inflation, and declining demand from Canada’s main seafood importer, the U.S.

But Japan, a relatively minor seafood importer for Canada, has been singled out, possibly due to the country's dramatic increase in Russian seafood imports over the past year. In an interview with CBC, Paul Grant, chair of the Association of Seafood Producers, an industry trade association representing seafood producers in Newfoundland and Labrador, noted that Japanese imports plummeted from approximately 9,000 tonnes per year over the last decade to just 3,000 tonnes in 2022. Meanwhile, Clifford Small, a Conservative MP from Newfoundland and Labrador, claimed that crab inventories would be empty if the “traditional market in Japan had been there.”

These statements exaggerate Japan’s market share and Tokyo has countered such claims. In 2021, for example, the Japanese market accounted for only 2.8 per cent of Canadian seafood exports, while 70 per cent of Canadian seafood exports went to the U.S. In fact, the significant drop in U.S imports of Canadian seafood is a much more important factor in Canadian fisheries’ current difficulties than declining Japanese imports.

Due to rock-bottom Russian prices, Canadian seafood exporters, for the time being, may find it hard to lure back Japanese customers. Once price pressures subside, however, Canadian exporters may be able to win back more of the small but valued Japanese market by emphasizing the sustainability of Canadian crab compared to alternatives.

What's Next

- Canada-Japan bilateral discussions

Atlantic Canada's rising concerns about snow crab sales have been registered with the federal government, with calls for Prime Minister Justin Trudeau to bring the issue directly to Japanese Prime Minister Kishida Fumio. While this discussion was reportedly not realized during the G7 summit, further inquiries from Canada to Japan are expected, with trade minister Mary Ng recently committing to continue to “stand up for Canadian fishers.”

- Further G7 co-operation to increase sanctions on Russia

The G7 has committed to sustaining sanctions on Russia. Yet Japan’s heavy reliance on Russia in energy, timber, and seafood have limited efforts in these sectors. The G7 could be expected to continue dialogue and co-operation among members and allies on how best to intensify sanctions while ensuring minimal negative impact on participating countries. Policies and subsidies promoting affordable, sustainable Canadian seafood could potentially benefit Atlantic Canadian fisheries and Japanese consumers.

• Produced by CAST’s Northeast Asia team: Dr. Scott Harrison (Senior Program Manager); Momo Sakudo (Analyst); Tae Yeon Eom (Analyst); and Sue Jeong (Analyst).