The Takeaway

From October 17 to 22, the deafening roar of the KF-21, South Korea’s homegrown fighter jet, dominated the skies at ADEX 2023, one of Asia’s largest aerospace and defence exhibitions, held biennially in South Korea. The KF-21’s speed and acrobatics — observed, in one notable demonstration, by South Korean President Yoon Suk Yeol and representatives from 58 countries — represent a resounding affirmation of South Korea’s dedication and strategic foresight in nurturing its defence industry, a critical pillar in the country’s economic and security framework.

In Brief

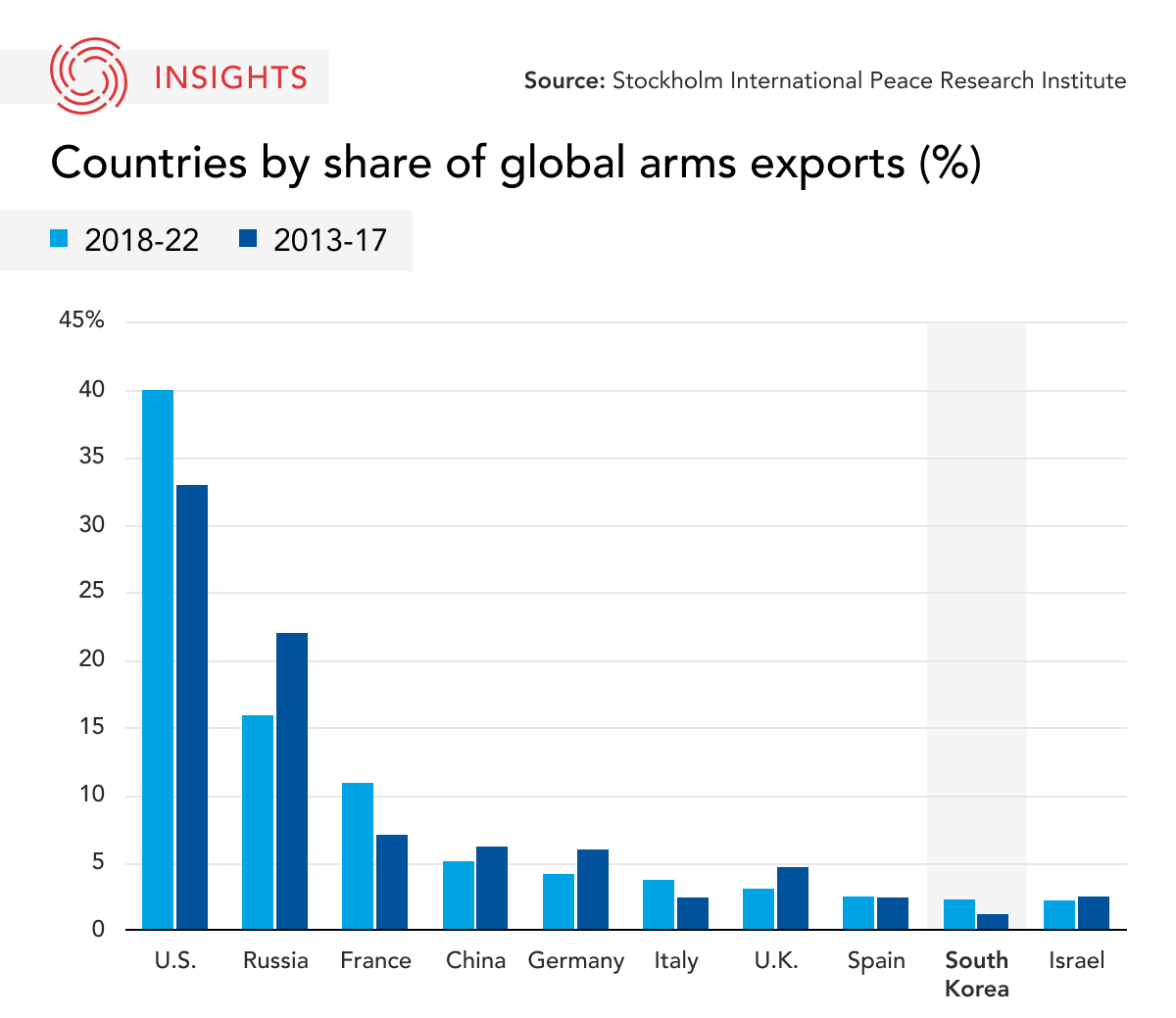

In the opening speech of the Seoul International Aerospace and Defense Exhibition (ADEX) 2023, Yoon identified the defence industry as a critical sector for South Korea’s future growth, pledging to elevate the country to the world’s fourth-largest global arms exporter by 2027, behind only the U.S., Russia, and France. The escalation in South Korea’s arms trade has sparked both high expectations for its potential to bolster the national economy, security, and technological advancement, and ethical and ideological concerns.

According to the global security think-tank Stockholm International Peace Research Institute, South Korea ranked ninth in global arms exports between 2018-22, capturing a 2.4 per cent share of the world’s arms export market. Notably, South Korean arms exports from 2018-22 increased 74 per cent compared to the total from the preceding five-year period of 2013-17. This growth rate is the highest among the world’s top 10 arms exporters.

The Russian invasion of Ukraine and various tensions in the Middle East have precipitated significant growth in South Korea’s aerospace and defence industry, allowing the country to grow into a powerful player in the international arms market.

Implications

The defence industry has emerged as a vital force in South Korea, generating quality employment opportunities and propelling balanced regional development as aerospace and military manufacturing units are chiefly situated beyond the crowded confines of the Seoul metropolitan area. Moreover, arms exports can yield lucrative sales deals and security pacts, fortifying South Korea’s national security and enhancing global security collaboration, which cements the country’s position in international defence circles.

From a technological standpoint, South Korea’s aerospace and defence sectors are progressing swiftly, with the KF-21 fighter jet and various surveillance satellites standing out as recent prominent achievements. These technological strides are poised to influence and benefit other high-tech sectors like the automobile and optic industries, underlining the extensive advantages of defence technology investments.

Nevertheless, there is increasing anxiety about the possibility of South Korean weapons ending up on the black market or inadvertently being used against civilians in conflict areas. Seoul was criticized, for example, for reportedly approving the export of a naval vessel to Myanmar in 2019. At the time, members of the country's military were under international sanctions for their roles in repressing Myanmar's Rohingya minority. South Korean trading company Posco International stated that the vessel was sold for civil support. Investigative reports, however, alleged that the company manipulated export documents and maintained the warship’s original design.

South Korea also invited Myanmar’s ambassador to an arms promotion event on May 10, 2023, prompting “strong concerns” from the Office of the UN High Commissioner for Human Rights (OHCHR). The OHCHR noted the event occurred just a month after the Myanmar military's airstrike in the Sagaing region, which killed 170 people.

Currently, South Korea’s arms exports are predominantly aimed at niche markets in less developed countries, leading to questions about the strategy’s sustainability and future prospects, particularly due to South Korea’s absence from major military markets such as the U.S. In addition, the potential ideological implications of North Korea’s suspected arms exports to Russia may add a layer of complexity to South Korea’s arms export dynamics, especially in relations with NATO countries.

What's Next

- Deepening military ties

Canadian military officials’ participation in ADEX 2023 and the Seoul Defense Dialogue (SDD) signifies an evolving bilateral partnership with South Korea, exemplified by collaborative aerospace and naval projects. The dialogue during the SDD’s Cyber Working Group Forum indicates a future focus on addressing challenges and opportunities in the military use of artificial intelligence and cyber threats, further solidifying Canada-South Korea military co-operation.

- Bolstering export finance

South Korean arms exports are financially supported by the Export-Import Bank of Korea and the Korea Trade Insurance Corporation. Legislative efforts are underway to increase the bank’s capital limits for more substantial weapon export contracts.

- Managing international competition

The rise of South Korea’s defence industry has caught the attention of established arms exporters, prompting a re-evaluation of their own military capabilities and market strategies. For instance, Germany is revamping its defence industry and has voiced concerns about South Korean tanks entering European markets, emphasizing the necessity for European solidarity and focus on the joint German-French tank project.

• Produced by CAST's Northeast Asia team: Dr. Scott Harrison (Senior Program Manager); Momo Sakudo (Analyst); and Tae Yeon Eom (Analyst). Edited by Ted Fraser. Design by Chloe Fenemore.