Australia 2020-2021 Budget, released in October 2020, consists of C$92.2B (AUD$98B) for response and recovery support – of that, C$23.5B (AUD$25B) is the COVID-19 Response Package, and C$69.6B (AUD$74B) is the JobMaker Plan. The budget is largely focused on increasing incomes for households and businesses, boosting manufacturing and infrastructure investment, and decreasing the unemployment rate by creating jobs.[1] The plan involves a variety of different sectors and priorities, but of particular interest for this report is the recovery plan’s actions on R&D, clean energy, and digitization.

First, Australia’s recovery plan committed an additional C$1.9B (AUD$2B) over the next four years to its pre-existing Research and Development Tax Incentive. The R&D tax incentive is meant to encourage businesses to conduct R&D activities by offsetting the cost. There are two main parts of this tax incentive: a 43.5 per cent refundable tax offset for eligible entities with aggregated turnovers of less than C$18.8M (AUD$20M) per year, and a 38.5 per cent non-refundable tax offset for any other eligible entity.[2] Canadian entities can qualify for this tax benefit if they set up: a permanent establishment in Australia, an Australian resident company, or a corporation that is an Australian resident for tax purposes.[3] The Australian government has stated that it focused on R&D because it drives technological innovation, which in turn leads to increased productivity and increased economic growth.

The budget also includes the government’s Digital Business Plan. The plan emphasizes that COVID-19 has sped up the adoption of digital technologies by both Australian businesses and consumers, showcasing the growing importance of prioritizing digitalization going forward. The Digital Business plan involves a C$764M (AUD$800M) investment “to enable businesses to take advantage of digital technologies to grow their businesses and create jobs as part of our economic recovery plan.”[4] For example, the plan includes a C$27.9M (AUD$29.2M) investment in the rollout of 5G; C$21.2M (AUD$22.2M) to expand the Australian Small Business Advisory Service, which includes the Digital Solutions program, the Digital Directors Training Package and the Digital Readiness Assessment; and, C$9.1 (AUD$9.6M) for fintech companies to export financial services and attract inbound FDI.[5] According to the plan, a focus on digital transformation will create jobs and increase productivity.

Finally, the government has also focused on clean energies. The recovery plan includes an investment in new energy technologies to create jobs and boost economic growth. The investment is C$1.81B (AUD$1.9B) to lower emissions and improve the sustainability of Australia’s energy supply. The investment includes C$47.7M (AUD$50M) towards the Carbon Capture Use and Storage Development Fund, C$67.1M (AUD$70.2M) toward a hydrogen export hub, and C$64M (AUD$67M) toward microgrids to deliver sustainable and reliable power to remote communities. There will also be an additional C$1.54B (AUD$1.62B) made available for the Australian Renewable Energy Agency (ARENA) to invest in new technologies that lower emissions.

According to APF Canada’s Investment Monitor, Australia is the largest destination in the Asia Pacific region for Canadian investors – from 2003 to 2020, Canadian investment in Australia totalled C$74.7B. With this, the Australian government’s focus and investment in the areas of R&D, clean energy, and digitization can provide significant opportunities for Canadian companies, especially considering Canada’s focus on those sectors post-COVID-19.

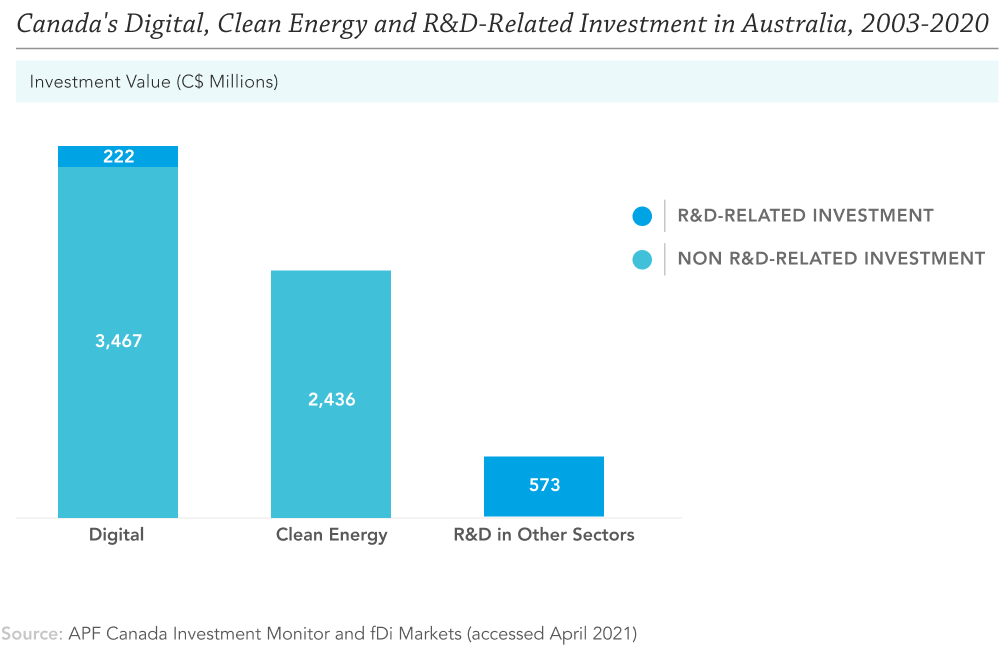

The digital sector is among the top sectors for Canadian investors in Australia, with C$1.3B invested in software and computer services and C$2.4B invested in technology hardware and equipment from 2003 to 2020 (C$3.7B total). The Ontario Teachers’ Pension Plan board accounts for the majority of those investments in terms of value, having invested C$2.2B in Australia’s digital sector since 2003. Its largest deal occurred in 2013 when the board acquired 70 per cent of three Australian telecommunications companies – Nextgen Networks, Metronode, and Infoplex – from Australia-based Leighton Holdings Limited. The acquisition was valued at C$1.05B.

Looking at clean energy, there were 16 Canadian outbound deals to Australia from 2003 to 2020, totalling C$2.4B. Of those deals, 12 were in alternative electricity, totalling C$2.4B, and four were in alternative energy, totalling C$49.3M. Canadian Solar Inc. has been especially active in this sector, having conducted seven deals between 2003 and 2020 totalling C$1.2B. The majority of these investments occurred in 2018 when Canadian Solar purchased five large solar power projects in New South Wales. Another recent notable deal is McCain’s investment of C$345M to add an 8.2-megawatt biogas energy facility to its site in Ballarat, Australia. The project will utilize a combination of solar and co-generation technology, and the electricity produced will supply the company’s food processing plant. The new system is expected to reduce the facility’s overall energy consumption by 39 per cent.[6]

Finally, other sectors in Australia have also seen Canadian R&D-associated investments. APF Canada’s Investment Monitor identified 16 Canadian R&D-related investments into Australia, totalling C$795M. The majority of these deals were in the pharmaceuticals sector (seven deals). Recent notable deals include Cronos Group’s subsidiary Cronos Australia opening a research and development centre in 2019 in Victoria, Australia, with a C$30.6M investment. Cronos Australia is a medicinal cannabis company, and the establishment of this R&D centre is expected to create approximately 120 new jobs.

Barriers to investment

Despite the opportunities these sectors can provide for Canadian companies, there are still barriers to investing in Australia. In March 2020, the government introduced temporary measures which required that all foreign investment into Australia be approved by the Foreign Investment Review Board (FIRB), regardless of the amount, sector, or investor.[7] This new screening also meant that the FIRB could take up to six months to approve an FDI proposal – compared with the 30 days it took before these new measures.

In December 2020, some of these regulations became permanent, coming into effect as of January 2021. Australia’s Parliament reformed the Foreign Acquisitions and Takeover Act of 1975, now requiring all foreign investors to have approval for any investment “that is sensitive to national security, regardless of value.”[8] It also holds that investors can be subject to “enhanced monitoring and investigation powers, as well as stronger and more flexible enforcement options and penalties,” and must also “continue bearing the costs of administering the foreign investment regime.”[9] It is expected that these new security-based regulations will most strongly affect telecommunications, energy and utilities investments, and some technology, services, and infrastructure investments.[10] These new screening measures could be a deterrent for certain Canadian companies due to time constraints and potential additional costs.

There are also domestic political pushbacks. The Lowy Institute Poll in 2019 found that 39 per cent of Australians believe that foreign investment in Australia is a “critical threat,” and 51 per cent of Australians believe that it is “an important but not critical threat.”[11] The Australian public seems to be especially against investments in Australia’s agricultural sector.[12] Another Lowy Institute poll conducted in 2016 found that 63 per cent of respondents were strongly against the Australian government allowing foreign companies to buy Australian farmland.[13] Negative perception over foreign investment could also pose regulatory uncertainty to Canadian companies intending to invest in Australia.

This is an excerpt from the Investment Monitor 2021: Report on Post-COVID Recovery and Foreign Direct Investment Between Canada and the Asia Pacific. For the full report, please click here. For case studies in other economies, please click below:

Endnotes

[1] “Budget 2020-2021: Overview.” Budget 2020-21. Department of the Treasury, October 6, 2020. https://budget.gov.au/2020-21/content/overview.htm.

[2] “Research and Development Tax Incentive.” Australian Taxation Office. Australian Taxation Office, July 31, 2020. https://www.ato.gov.au/Business/Research-and-development-tax-incentive/.

[3] “Foreign Tax Offset: U.S. Businesses Are Now Eligible to Claim a 43.5% Cash Rebate for R&D Costs Incurred in Australia.” Swanson Reed. Swanson Reed, July 14, 2017. https://www.swansonreed.com.au/product/45-foreign-rebate-for-australian-rd-costs-us/.

[4] “Digital Business Plan to Drive Australia's Economic Recovery.” Prime Minister of Australia. Prime Minister of Australia, September 29, 2020. https://papersowl.com/discover/digital-business-plan-to-drive-australias-economic-recovery.

[5] “Digital Business Plan to Drive Australia's Economic Recovery.” Prime Minister of Australia. Prime Minister of Australia, September 29, 2020. https://www.pm.gov.au/media/digital-business-plan-drive-australias-economic-recovery.

[6] Johnston, Poppy. “McCain Foods Go Big in Ballarat with Renewables.” The Fifth Estate, August 28, 2020. https://www.thefifthestate.com.au/innovation/industrial/mccain-foods-go-big-with-8-2-megawatt-renewable-system/.

[7] Lo, Isaac, and Sainbuyan Munkhbat. “Worry Over COVID-Related 'Fire Sales' Sparks Heightened Protectionist Measures in the Asia Pacific.” Asia Pacific Foundation of Canada, May 29, 2020. https://www.asiapacific.ca/publication/worry-over-covid-related-fire-sales-sparks-heightened.

[8] “Tightening of the Foreign Investment Review Framework.” Investment Policy Monitor . UNCTAD Investment Policy Hub, January 1, 2021. https://investmentpolicy.unctad.org/investment-policy-monitor/measures/3624/australia-tightening-of-the-foreign-investment-review-framework.

<[9] “Tightening of the Foreign Investment Review Framework.” Investment Policy Monitor. UNCTAD Investment Policy Hub, January 1, 2021. https://investmentpolicy.unctad.org/investment-policy-monitor/measures/3624/australia-tightening-of-the-foreign-investment-review-framework.

[10] “New Foreign Investment Laws in Place from 1 January 2021.” PricewaterhouseCoopers. PricewaterhouseCoopers, December 14, 2020. https://www.pwc.com.au/legal/publications/new-foreign-investment-laws.html.

[11] Needham, Kirsty, and Scott Murdoch. “Australia Shakes up Foreign Investment Laws for National Security.” Reuters. Thomson Reuters, June 4, 2020. https://www.reuters.com/article/us-australia-investment-idUSKBN23C01J.

[12] Kassam, Natasha. “Lowy Institute Poll 2019.” Lowy Institute. Lowy Institute, June 26, 2019. https://www.lowyinstitute.org/publications/lowy-institute-poll-2019.

[13] Tracey, Mollie. “Report Shows Foreign Investment Trends.” Farm Weekly, July 14, 2020. https://www.farmweekly.com.au/story/6824710/report-shows-foreign-investment-trends/.

[14] “Foreign Acquisitions of Farmland.” Lowy Institute Poll 2020. Lowy Institute, 2020. https://poll.lowyinstitute.org/charts/foreign-acquisitions-of-farmland/.