The Takeaway

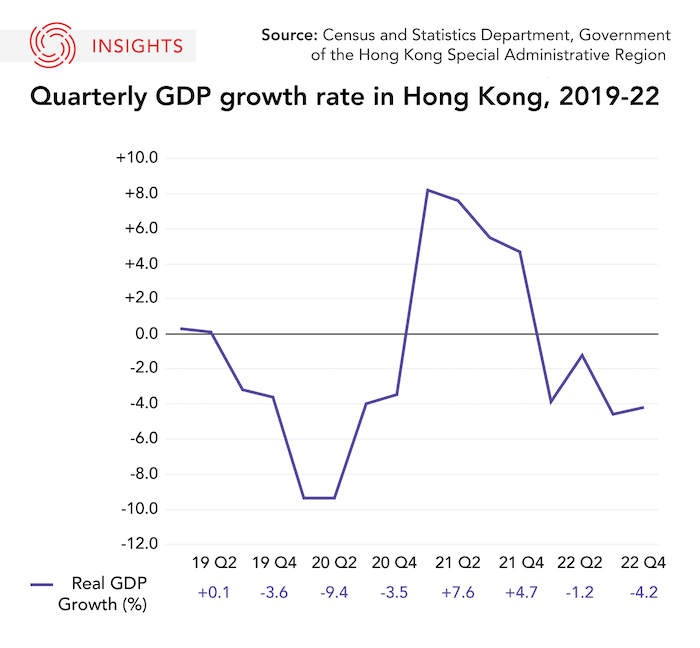

Hong Kong recorded its second-worst year for GDP since 2020 after seeing four consecutive quarters in the red. Heavily hit on trade and investment during a pandemic restriction-embroiled year, the city is betting that reopening borders could revive its much-disrupted flows of tourism, trade, and investment.

In Brief

Hong Kong’s economy under-performed in 2022 and contracted by 3.5 per cent in real terms year-on-year, according to advance estimates released by the city’s Census and Statistics Department (C&SD) on February 1, 2023. Trade in goods suffered the heaviest blow, with exports decreasing by 13.9 per cent and imports by 13.1 per cent. The government consumption expenditure, covering expenditures on goods and services by government departments not engaged in market activities, increased by 8.1 per cent compared to 2021 — the most among all GDP components.

Notably, the estimates also showed an unexpected 4.2 per cent decline in GDP in the fourth quarter, squashing the more optimistic forecast of a 1.8 per cent expansion over the same period by the University of Hong Kong in October 2022. This means Hong Kong saw negative GDP growth in all four fiscal quarters of 2022. The most heavily hit category in the fourth quarter was trade in goods: exports were down 24.8 per cent, while imports slumped 22.8 per cent. Besides trade in goods, gross domestic fixed capital formation also saw a 11.2 per cent drop in the fourth quarter, and experienced negative growth throughout 2022.

Implications

In the advance estimates, weak supply and demand — which were substantially impacted by “the fifth wave of [the] local epidemic,” rising global inflation, and worsening financial conditions, according to the C&SD — were identified as the main factors contributing to the GDP contraction. Hong Kong, as a trade-dependent economy, dealt with the dual blows of a worsened international market environment and “disruptions to cross-boundary truck movements,” resulting in historic lows in its recent export figures.

The city’s economic struggle in 2022 was evident from the record-high losses it suffered in the financial market. The Hong Kong Exchange Fund, the city’s de facto “war-chest fund,” recorded its worst deficit since the Great Recession of 2008, and experienced negative returns in all equities, bonds, and non-USD currency exchanges for the first time in almost half a century. The investment loss of C$34.61 billion (202.4 billion Hong Kong dollars) in 2022 was a result of the volatilities brought on by U.S. interest rate hikes, as well as a worsening geopolitical environment due to the Russia-Ukraine war and deteriorating U.S.-China ties. Disruptions from zero-COVID policies are also believed to have impacted global investors’ confidence in Hong Kong.

Expert sentiment of late has, nonetheless, improved regarding Hong Kong’s potential economic recovery in 2023, as many suspect the resumption of trade and tourism across the Hong Kong-mainland border will boost the city’s sluggish retail and service sectors. With the last remaining testing requirements and quota restrictions for cross-border travel removed on February 6, the government is hoping for “the return of economic activities” and the restoration of its much-disrupted supply chains. Analysts are eyeing a strong GDP rebound, with some expecting a figure as high as 3.8 per cent. Easing border restrictions is also expected to generate more private consumption activities, which already saw a moderate uptick of 1.7 per cent in the fourth quarter of 2022. Drawing tourists back and boosting their spending in Hong Kong, which generated C$47 billion ($276 billion Hong Kong dollars) in revenue for the city in 2019, will play a crucial role.

What's Next

- Doubling down on tourism

With the recent border reopening, Hong Kong is eager to rebuild a key economic pillar and is investing heavily to increase its appeal to global tourists. Campaigns such as giving out 500,000 free inbound plane tickets and millions of spending vouchers to visiting tourists will likely generate some initial benefits, but the city also faces fierce competition from other regional aviation and cultural hubs.

- Keeping up with key regional competitor

Industry watchers often see Singapore as a lucrative alternative to Hong Kong, as the city-state reaps the benefit of being one of Asia’s earliest to step out of the shadow of COVID-19 lockdowns. Hong Kong’s business community, however, points to Hong Kong’s more sizable financial sector and stock exchange as reasons to remain confident. As more Chinese companies may delist from the U.S. stock market and seek to debut in the Hong Kong Stock Exchange, its stock market, worth C$7.2 trillion (42 trillion Hong Kong dollars), is banking on a strong comeback.

- Stepping up the diversification game

In what he called a “fruitful” trip, Hong Kong Chief Executive John Lee’s recent visit to the Middle East was a chance for the city to reconnect to the global investment pool and forge closer business ties with regional partners. With a focus on green finance and sustainability, Hong Kong’s efforts to lure new Middle East investors will need a kick-start by raising the awareness of what Hong Kong can offer.

• Produced by CAST’s Greater China team: Maya Liu (Program Manager); Liam Lau (Analyst); and Irene Zhang (Analyst).