The Takeaway

India, a late entrant to the electric vehicle (EV) market, has seen a massive uptick in EV usage over the last three years. The growth has been largely driven by central and state policy measures, including incentives for the production and use of EVs. Recently, both domestic and international players, such as Ola Electric, Mahindra, Renault-Nissan, and Volvo, are either already committed to or considering India for their EV manufacturing hubs. However, if India aims to meet its EV adoption targets, it is important for policymakers to address some key bottlenecks, such as EV charging infrastructure and access to raw materials.

In Brief

On February 19, Indian automobile manufacturer Ola Electric announced its plan to invest C$1.2 billion (76 billion Indian rupees) in setting up the “world’s largest” EV hub in Tamil Nadu. This announcement came only days after the Tamil Nadu state government shared its revised EV policy for the 2023-28 period. Earlier, on February 13, a strategic alliance between carmakers Renault and Nissan said they would be making their first set of EVs in India, at their plant in Tamil Nadu.

Implications

While India has only recently jumped on the EV bandwagon, its huge consumer market means that sales will likely increase in the coming decade. India’s EV sector got a major push in 2015 with an important policy measure: the announcement of the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME I) policy under the National Electric Mobility Mission Plan, which promised financial support to customers purchasing electric and hybrid vehicles. The second phase of the policy, known as FAME II, followed in 2019 and aimed to provide financial support for the electrification of public transport vehicles and the installation of EV charging points. Further, between 2015 and 2022, 26 state governments announced their own EV policies, with production and sales-linked subsidies. These measures reportedly resulted in India’s EV sales growing by over 2,000 per cent since 2019.

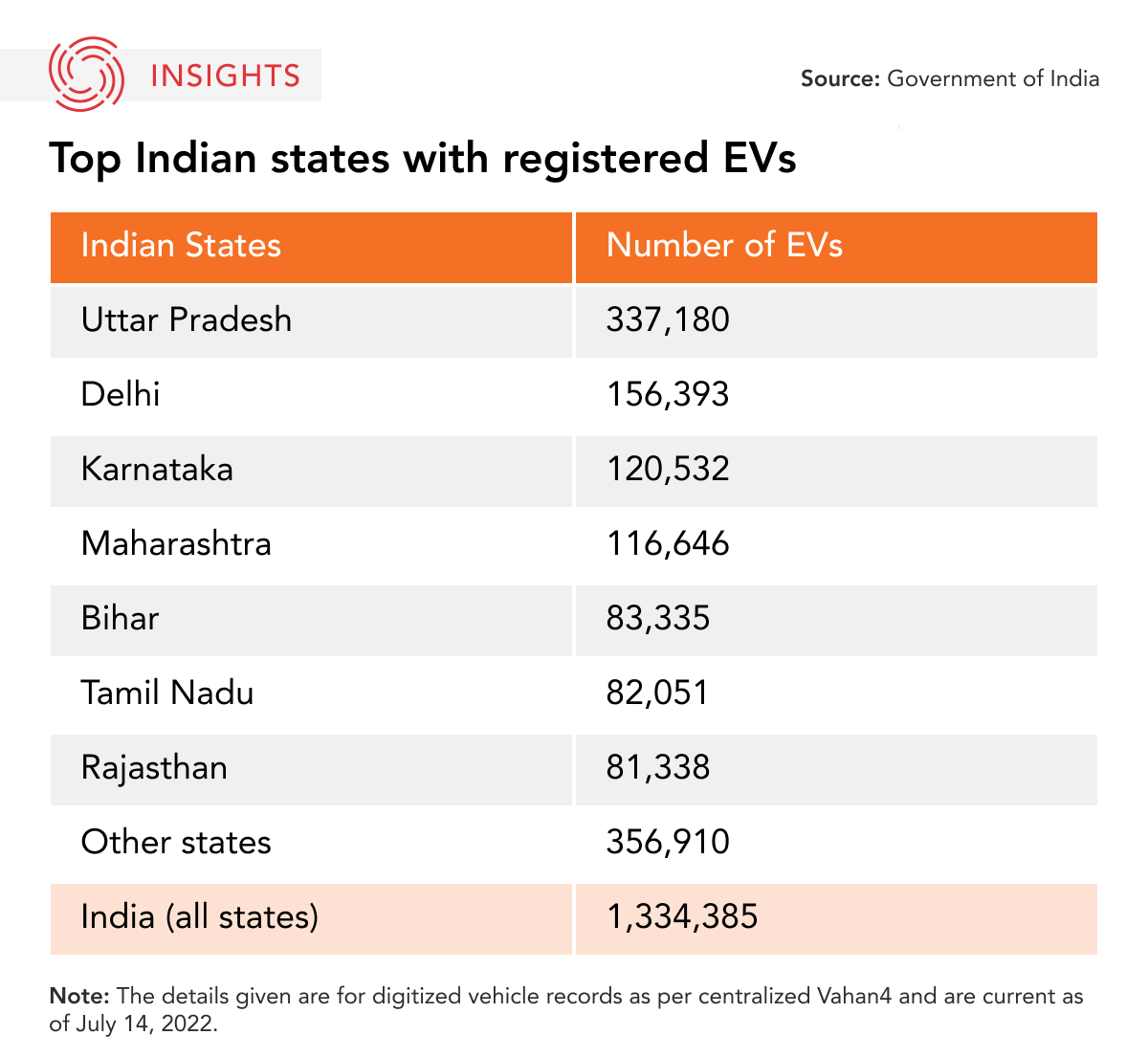

As of July 2022, there are more than 1.3 million registered EVs in India. Around 96.25 per cent of these vehicles are two-wheelers and three-wheelers. Poor road infrastructure and a gap between the prices of two-wheelers and four-wheelers mean that around 70 per cent of automobiles on Indian roads are two-wheelers. This trend has continued with the introduction of EVs. Incentives offered under FAME I and II have implicitly prioritized two-wheelers and three-wheelers (e.g. e-autorickshaws, cargo vehicles, etc.) over four-wheelers. In the case of two-wheelers and three-wheelers, the subsidy could be up to 40 per cent of the cost of the vehicle. In the case of four-wheelers, it amounts to around 20 per cent of the cost.

Many Indian states have also devised ambitious targets for going electric in terms of public transportation. While sales of electric buses at present constitute an insignificant percentage of the total EV sales, many states have set adoption and conversion targets that could result in up to 30 per cent of public transport going electric by 2030.

What’s next:

-

Charging infrastructure

The Indian government plans to increase the proportion of EVs on the road from around two per cent of vehicles on Indian roads to at least 30 per cent by 2030, but this requires a massive upgrade of EV charging infrastructure. India currently has 5,151 working EV charging stations, but it needs to increase that number to around 2.05 million by 2030 to service the expected increase in EVs. The government’s draft policy for battery swapping, and the recent inflow of investment into that space, such as that by Taiwan’s Gogoro, has also stirred some debate about its possible implications for a sustainable EV market growth.

-

Raw materials

Another stumbling block for India will be its increased demand for the raw materials used to manufacture EVs. This will likely increase India’s dependence on China, which processes more than 60 per cent of the world’s lithium, cobalt, and manganese, some of the key materials used in EV batteries. The recent discovery of lithium reserves in Jammu and Kashmir has caused some optimism on this front, but it will be another five years before mining can even begin and even then the proposition is not without environmental and social concerns.

-

Financial costs of going electric

The costs of purchasing and operating an EV remain high. An average user may have to spend at least 48 per cent more on a low-priced e-scooter, compared to a regular scooter. Furthermore, state subsidies have an expiry date, suggesting that a long-term incentive structure needs to be developed to encourage the adoption of such vehicles. That said, the high upfront cost of an EV is primarily due to the cost of lithium batteries, which could see a drop as production and usage increase. Additionally, in the long term, the cost of operating and maintaining an EV is likely to be lower than petrol or diesel-based vehicles.

• Produced by CAST's South Asia Team: Dr. Sreyoshi Dey (Program Manager); Prerana Das (Analyst); Suyesha Dutta (Analyst); Narayanan (Hari) Gopalan Lakshmi (Analyst); and Silvia Rozario (Analyst).