With additional research and writing by Phebe Ferrer, Junior Research Scholar, and Isaac Lo, Post-graduate Research Scholar, at APF Canada

The recent release of the long-awaited Phase One trade deal between the United States and China has been met with understandable concern among Canadian exporters. With no immediate end in sight to Canada’s own challenges in exporting to China, Beijing’s commitment to purchase an additional US$200 billion (C$260 billion) in select U.S. goods and services above 2017 levels over the next two years raises the risk that even more Canadian exporters will find themselves locked out of the China market – this time, due to U.S. exporters taking up market share that would otherwise be filled with Canadian exports.

But not all exports are included in the deal: while the list of 547 U.S. export goods looks daunting, it mostly covers agricultural and manufactured goods, along with a handful of energy products. And the deal’s US$200-billion total also includes an agreement by China to buy US$37.9 billion in U.S. services.

A political decision

On goods, Canada exported an estimated US$17 billion to China last year, or one-twelfth the amount China has agreed to purchase from the U.S. under Phase One of the new trade deal. All goods on the list that Canada also exports could, in a worst-case scenario, be swamped out of the Chinese market. China’s decision on whether or not to cut Canadian exports in favour of American exports will ultimately be a political one, as the deal breaks with traditional rules – like open price and tariff competition – adopted by the WTO or common free trade agreements and instead insists on quotas and forced purchases. The list of required U.S. exports also includes goods and services exported by major Chinese partners like Australia, Brazil, and the European Union, potentially impacting those economies as well. A complicating factor, as these countries are also strong American allies.

Ultimately, the deal does not get into the specifics of how much of each good must be purchased by China from the U.S., with only high-level totals for agriculture, manufactured goods, and energy products outlined. This adds another layer of uncertainty to the deal, as it leaves China in the highly-discretionary position of being able to decide what it might cut from other economies, and when.

More likely than a worst-case scenario is one in which some Canadian exports lose a lot, while others that are harder for China to switch away from, lose a little. How, then, to identify which of the 547 U.S. goods listed in the Phase One deal could hurt Canadian exporters the most? To answer that question, the Asia Pacific Foundation of Canada analyzed both the risk of a Chinese switch away from a specific Canadian export, and the lost value that switch represents.

In the crosshairs

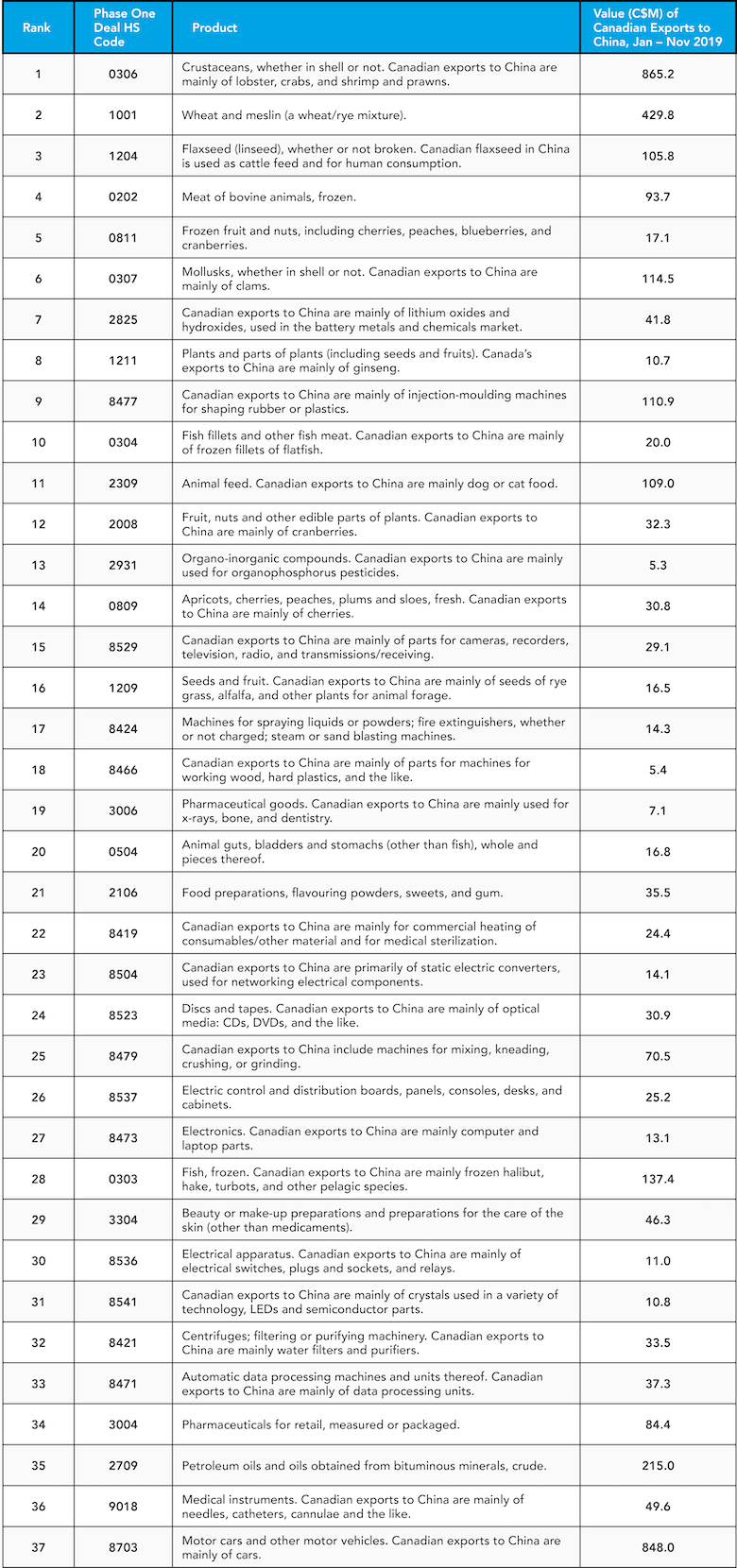

We identified 37 Canadian exports facing a likely and significant risk as a result of the Phase One deal (See: trade chart below). Of that 37, six exports face special risk: crustaceans (namely, Atlantic Canada lobster), wheat, flaxseed (linseed), cattle meat, fruit and nuts, and mollusks.

Here are our top-four takeaways from an analysis of Canada’s at-risk exports under Phase One of the U.S.-China trade deal:

- FROM THE SEA: Some Canadian exports are in for significant pain given their overall value and recent growth against U.S. exports. Of all goods, Canadian crustacean exports are the most at risk. China is a C$500-million annual market for Canadian lobster, a C$300-million market for crabs, and a C$200-million market for shrimp and prawns. While the deal doesn’t specify just how much lobster and other crustaceans China must purchase from the U.S., the Phase One deal very specifically includes lobster as something to be included in the new purchase commitments. Also at risk: the C$40-million market for Canadian clams, among other mollusks, covered by similar language to crustaceans under the new deal. One bright note: High-end restaurants in Asia value Canada’s Atlantic lobster as a specialty, which may preserve some valuable market share for these crustaceans – though the past few weeks’ immediate drop in lobster exports due to the coronavirus’ impacts on the China market, shows just how susceptible Canadian exporters are.

- FROM THE FIELD: Canada’s wheat and flaxseed exports are also at risk. China is a C$500-million annual market for Canadian wheat, and C$100-million market for flaxseed, primarily used as livestock feed. Frozen beef is also at high risk of losing market share to the U.S., putting Canada’s C$100-million in frozen beef exports to China at risk. Rounding out the high-risk list: Canada’s C$20 million in annual exports of frozen fruits and nuts to China.

- ALREADY IN FLUX: Some high-profile Canadian exports may be less of a concern than others. Canola and soy are important to Canadian exports, with both agri-products included in the Phase One agreement. But Canada’s own tariff tiff with China over canola and lowered demand for soy-based pig feed amid China’s swine fever crisis mean Canada’s exports of these goods is already currently very low, with Phase One of the deal adding little additional pain.

- THE SOFTER HITS: Canadian fish exports in general are at risk, but the U.S. already has a strong history of exporting fish to China, so the additional risk to Canada is marginal. China’s agreement to start importing salmon oil from the U.S., among other specific fish products, however, could harm some Canadian exporters disproportionately. Loss of lumber and motor vehicle market shares could also hurt. But U.S. lumber exports to China were already dropping before the trade war, so it is unlikely that Canada will see a large surge in U.S. lumber exports displacing our product in the Chinese market. And Canada’s market share in the automotive sector in China is already small compared to the U.S., meaning Canada has less to lose in that sector – while Canadian exporters who have somehow managed to maintain a foothold in the Chinese market likely have a stronger competitive edge than their U.S. competitors.

Canada's policy response

The Phase One U.S.-China trade deal definitely breaks with basic WTO rules, including the ‘Most Favoured Nation’ principle that prohibits exclusive compulsory deals that directly affect free market competition. With the European Union already analyzing the deal with a view to raising a case with the WTO, Canada should consult closely with European and other impacted countries to co-ordinate an effective multilateral response.

Most significantly, Canada needs to start negotiating clear rules of understanding regarding trade with China in an attempt to decouple trade issues from the political standoff over the arrest of Meng Wanzhou in Canada and Michael Kovrig and Michael Spavor in China. Not doing so could lock the present, difficult situation into a long-term, structural crisis for Canadian traditional exporters of goods, particularly agricultural goods, to China. The potential losses to the Phase One deal will likely be highly concentrated in Canada’s Atlantic provinces, the Prairie provinces, and British Columbia, all of which stand to lose disproportionately from China’s compliance with the US agreement.

Other early analysis of the Phase One deal by the Peterson International of International Economics reinforces warnings about the unrealistic purchasing expectations of the Trump administration. If China wants to get as close as possible to compliance, it will have to cut purchases from elsewhere. Canada needs to be assertive and act immediately to avoid export losses – while quickly finding new markets for products under threat.

Indeed, Canada will need to enter the 2020s with a more proactive mindset on trade. The last half decade has introduced a number of shocks to our trading system, and more will come. In some export categories, Canada has in fact gained from the U.S.-China trade war, becoming an alternative of choice for buyers in both economies. But other Canadian exports have been hurt by the ever-changing landscape of new tariffs, trade quotas, and even tweets.

On the whole, Phase One of the U.S.-China trade deal should serve as wake-up call to Canadian exporters and policy-makers. How sudden and abrupt the sea changes in today’s global economy, with the main tasks now including both a closer look at Canadian export goods that could be at risk under this latest deal and co-ordination around appropriate responses and strategies. Canada would do well to begin seeking alternative markets for these at-risk products while accelerating the pace of negotiations at the multilateral and bilateral levels to mitigate the impending impacts to free competition and trade on both sides of the Pacific. Inaction is no longer an option.

37 Canadian Exports at Significant Risk Under Phase One of the U.S.-China Trade Deal