The Takeaway

As an imported egg controversy continues to rage in Taiwan, the government’s response to food shortages and its handling of imported food products — particularly failures to address labelling issues and alleged favouritism to certain vendors, both complicated by a vulnerable industry model — have prompted public concerns over food safety. The imbroglio comes as the island’s presidential election, set for January 2024, draws closer.

In Brief

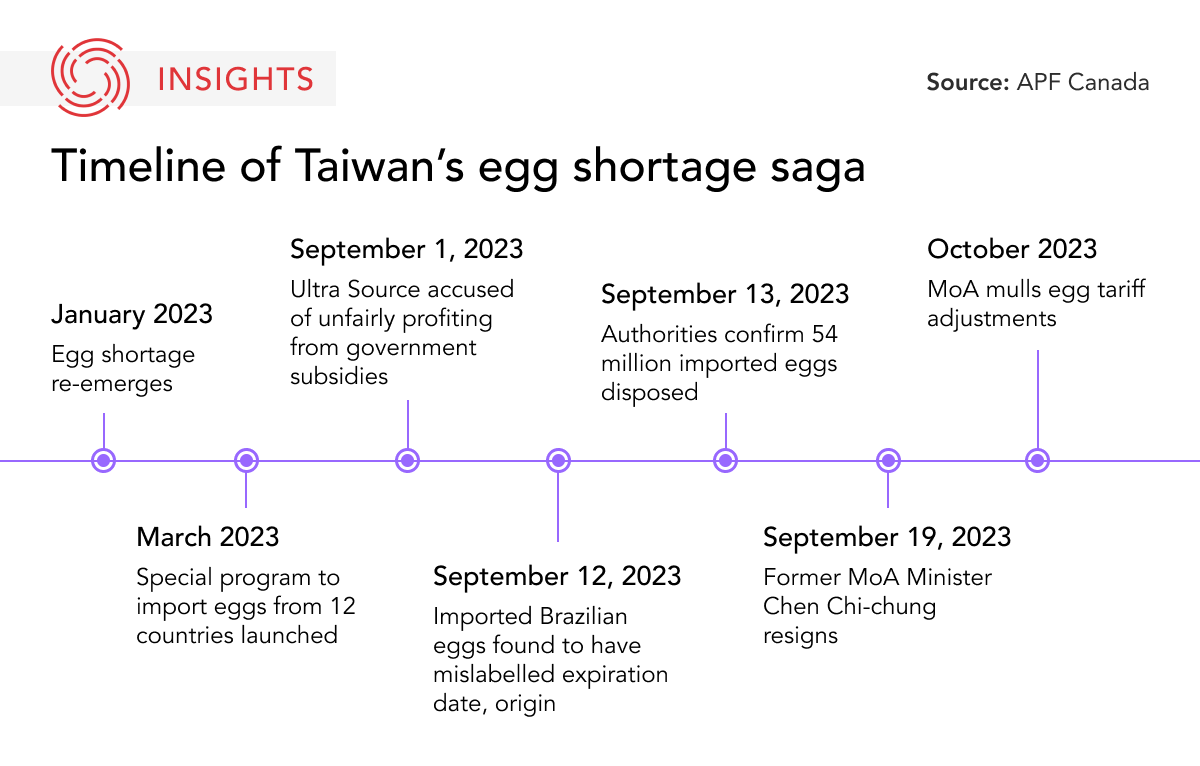

- On October 11, Chen Junne-jih, Taiwan’s acting minister of agriculture, revealed that his ministry is considering lowering the current 30 per cent tariff on chicken egg imports. The minister also announced that the Ministry of Agriculture (MoA) will begin publishing data on daily local egg production to allow domestic traders to assess their import needs independently. While details regarding the timing, extent, and duration of tariff adjustments are still under discussion, it is understood that the policy will be applied for restricted periods and on a limited quantity of eggs.

- Taiwan’s island-wide egg shortage saga started in early 2023. Facing criticism for apparent inaction, the MoA rolled out a special program in March 2023 to increase egg supply from 12 source countries, including Canada. The program, funded with C$24.13 million (570 million New Taiwan dollars) in subsidies, helped bring 145.31 million eggs to Taiwan between March and July and stabilized rising prices.

- In early September, several politicians from the main opposition party, Kuomintang, accused Kaohsiung-based vendor Ultra Source of profiting from favouritism, arguing that the vendor received an exceptionally large share of government subsidies.

- A week later, media outlets in Taiwan reported that some batches of Brazil-origin eggs on the market were incorrectly labelled with later expiration dates. Tainung Egg Products Co. and Sin Sing Eggs, two importers found to be mislabelling the sources and expiration dates of their egg products, were fined C$479,090 (1.13 million New Taiwan dollars) by Kaohsiung City authorities.

- By September 13, all 2,000 boxes of Tainung’s egg products imported from Brazil were recalled. The MoA revealed three days later that about 54 million — or 37 per cent of all eggs imported between March and July — had to be discarded due to either expiration or damage. As a result of raging public criticism, Minister of Agriculture Chen Chi-chung resigned on September 19. Taiwanese President Tsai Ing-wen subsequently pledged a comprehensive review of the egg importation program to restore public trust.

Implications

Egg shortages have been a recurring issue in Taiwan in recent years. When the island faced a 1.6-million daily egg deficit because of bird flu, pricier feed, and COVID-19 disruptions in January 2022, the MoA introduced a temporary egg price cap and subsidies for farmers and brought in imported eggs from Australia, Japan, and the U.S. While these measures seemed to have eased the crisis, the shortage re-emerged this year for similar reasons.

Part of the unaddressed root cause lies in Taiwan’s failure to upgrade egg production systems across the island’s chicken farms. As approximately 80 to 90 per cent of hens in Taiwan are still reared in crowded 'battery cages,' egg outputs remain vulnerable to the spread of viruses. While the agricultural ministry invested in a three-year infrastructure upgrade program for farmers to convert poultry houses to open sheds and introduce ‘smart’ equipment, most farmers found it difficult to pass the aid program’s screening process. A self-initiated infrastructure overhaul also does not come cheap.

Taiwan's egg-producing industry relies on a rigid supply chain model. Since the 1970s, egg farmers in Taiwan have sold around 80 per cent of their products to large egg vendors through a so-called ‘exclusive sales system,’ in which the per-catty price (one Taiwan catty equals 600 grams) is fixed by a supervising committee, regardless of the egg’s size or quality. Such an arrangement, featuring strong regionalism and relationship-based practices, makes it hard for market mechanisms to work in times of constrained supply. These factors removed farmers’ incentive to boost production and gave rise to the birth of ‘black markets’ that further scrambled the distribution of eggs.

Taiwan’s ineffective handling of its egg supply is further complicated by deep-seated food safety challenges. To this day, many Taiwanese remain cautious about consuming pork products with ractopamine (an additive put into animal feed) imported from the U.S., though a referendum to reimpose a ban on such products failed in 2021. In one recent case, two pork importers from Taoyuan were found to have falsely labelled the countries of origin as Canada and the U.K. rather than the U.S., from which the vendors bought around 140,000 kilograms of frozen meat. Loopholes in establishing accurate source-labelling and traceability of imported food — something authorities said was under control — could further deteriorate public trust and ramp up political pressure if not addressed.

What's Next

- DPP’s presidential election prospects remain strong despite scandal

A new survey conducted by the Taiwanese Public Opinion Foundation indicated that Tsai’s approval rating dropped to a record low of 38.4 per cent in September — down 10.4 percentage points from just a month prior. Experts say the incident is unlikely to deal a significant blow to the ruling Democratic Progressive Party’s (DPP) presidential bid next January, as candidate Lai Ching-te, according to one poll, continues to lead. More than half of respondents from the same poll, however, expressed dissatisfaction over the former agriculture minister’s handling of the egg issues.

- Industry players push for more dramatic changes to ramp up resilience

While the MoA said it would continue strengthening egg farm infrastructure and egg transportation logistics, industry stakeholders and experts are advocating for stronger government action beyond upgrading sheds. Some stakeholders are calling for the introduction of a more market-based, initiative-driven production and sales structure to bring about thorough, genuine changes to the egg supply system.

• Produced by CAST's Greater China team: Maya Liu (Program Manager); Karen Hui (Analyst); and Chloe Yeung (Analyst).