The sharp increase in foreign direct investment (FDI) in China’s service sector and advanced manufacturing sector was a noteworthy trend in 2015. Inward FDI has played an important role in China’s economic development, on average contributing to 50 per cent of China’s foreign trade, 25 per cent of its industry outputs, 15 per cent of urban employment, and 20 per cent of its tax revenue. Any change in FDI flows, therefore, is likely to have an impact on the country’s economic structure and domestic economy.

Increasing Flow of FDI to the Service Sector and the Advanced Manufacturing Sector

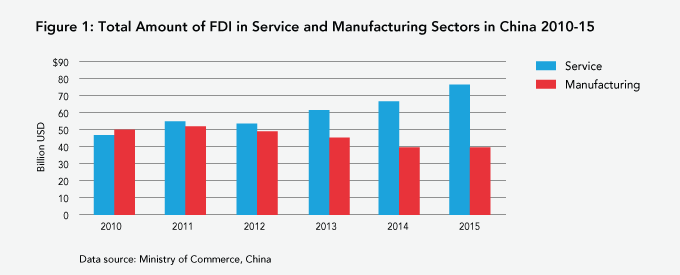

FDI to China is moving away from the low-cost processing sectors to the higher, value-added service and advanced manufacturing sectors. 2015 marked the third consecutive year for such a trend, with a total of $US77.2 billion, or 61.1% of total inward FDI, going to the service sector. That was a 13 per cent increase from 2012, as shown in Figure 1. At the same time, almost one quarter of FDI in the manufacturing sector went to high and new technological manufacturing, an increase of 9.5 per cent over the previous year. [1]

This trend is explained by increased production or operation costs in processing sectors due to rising labour costs and land costs, appreciation of the Renminbi, the phasing out of preferential policies for foreign investment, and China’s emphasis on environmental protection. As a result, the investment in processing sectors seen during earlier days is no longer profitable or lucrative, and more investment is going to the advanced manufacturing or service sectors, which create a higher added value.

In addition to this trend, there are three other features of current FDI flows that should be noted.

1. The east coast is the main destination for FDI to China

With China’s rapidly expanding middle class, particularly in urban centres on the east coast, consumption is increasingly contributing to the Chinese economy. In 2015, 66.4 per cent of China’s economic growth was fuelled by consumption. The total amount of retail commodities is growing by double digits.

Given their strong consumption capacities and relatively developed legal environments, it is not surprising that the east coast urban centers are attracting a lion’s share of foreign investment. Foreign investment has been concentrating mainly in the Yangtze River Delta with Shanghai, Jiangsu and Zhejiang, in the Pearl River Delta with Guangdong and Shenzhen, and in the Bohai Bay with Beijing and Tianjin. In general, these coastal areas receive 80 per cent of the total foreign investment, while the central and western areas receive 10 per cent each. In 2015, Shanghai attracted a total of $US18.5 billion in foreign investment, while Qinghai province in the western part of China received only $US60 million.

2. Hong Kong dominates as the source of FDI

Of all the sources of FDI to China, investment from Hong Kong dominated in 2015, constituting 73 per cent of the total at $US92.67 billion. Economies with strong manufacturing capacities like Japan, Germany and the U.K. had less of a share of China’s inward foreign investment. In particular, investment from Japan in 2015 was over $US4 billion less than its investment in 2012, with Japan’s ranking dropping from 2nd in 2012 to 5th in 2015.

Many foreign companies in the service sectors choose to make their investment in China through their establishments in Hong Kong, making Hong Kong the No. 1 source of FDI to China.

3. Mergers and Acquisitions (M&A) are Becoming More Common

More and more foreign companies are using M&A as a way of investing in China. After years of industrialization, China has developed industries in many sectors that would not have existed before the country’s recent reforms and opening to overseas capital. Nowadays, foreign companies no longer need to start a brand new company or plant in China, nor wait for a long period before actual production can begin. They can start production within a much shorter period by purchasing a share of domestic enterprises and using domestically produced inputs.

In 2015, 1,466 foreign invested enterprises[2] in China were established through M&A, for a total of $US17.77 billion, 1.37 times more than the previous year. In terms of investment amount, FDI through M&A increased from 6.3 per cent in 2014 to 14.1 per cent in 2015. It is possible that M&A will continue to be an important way of foreign investment entering China in the future.

4. Looking to the Future

As they look to the future, foreign investors interested in investment in China will need to carefully study the different segments of the market to assess their growth potential and to target the right consumers[3].

Opportunities in the service and advanced manufacturing sectors are likely to continue as Chinese policies attempt to direct more investment to these sectors. China’s 13th Five Year Plan, a blueprint for the country’s social and economic development over the next five years 2016-2020, encourages foreign investment to enter sectors like advanced manufacturing, high and new technologies, energy conservation and environmental protection, and modern services such as financial service, legal, accounting & consulting service, education & training, health care, entertainment, tourism, etc. The 2025 Made in China Strategy, China’s first 10-year national plan on transforming manufacturing, expands opportunities for foreign companies with innovative and advanced technologies, especially in information technology, advanced machinery, new materials, bio-medical technology and clean technology. The Belt Road Initiative, a comprehensive plan aiming to connect major Eurasian economies through infrastructure, trade and investment, encourages foreign companies to partner with Chinese companies on infrastructure projects in these markets.

Similarly, opportunities for investment in coastal areas in the east are likely to continue as these regions continue to be engines of economic development.

[1] 凤凰资讯: ”发改委:深入实施新一轮高水平对外开放”, http://news.ifeng.com/a/20160229/47626458_0.shtml

[2] Foreign invested enterprise refers to a legal entity established in China with foreign investment accounting for 25% or more of the registered capital of the entity.

[3] As a first step, companies interested in investing can refer to APF Canada's Guidebook to Doing Business in Asia at http://www.asiapacific.ca/research-report/guidebook-doing-business-asia-resource-bc-smes