In October 2020, the Quebec government unveiled its Plan for the Development of Critical and Strategic Minerals 2020-2025, the first of its kind in Canada, to leverage the province’s mineral resources and become a leader in the global energy transition. Rich in critical minerals such as lithium, cobalt, and nickel and with an abundance of hydroelectricity and skilled labour, Quebec has invested billions in developing the fast-growing lithium-ion battery sector to power electric vehicles (EVs).

Quebec’s ambition to become a hub for critical minerals and EVs gained momentum under the Inflation Reduction Act (IRA) and the EV tax credit implemented during the Biden administration. Under the IRA, 80 per cent of the critical minerals contained in EV batteries have to be processed or mined in North America by 2027, increasing to 100 per cent by 2029. The proposed integration of the North American critical mineral and EV battery markets has contributed to a surge in foreign direct investment (FDI) in Quebec, offering significant export opportunities for companies within an integrated supply chain.

Since taking office, President Trump has signed several executive orders related to energy and critical minerals, including "Unleashing American Energy" (EO 14154), "Declaring a National Energy Emergency" (EO 14156), and Ensuring National Security and Economic Resilience Through Section 232 Actions on Processed Critical Minerals and Derivative Products (EO14272). Together, these orders direct federal agencies to accelerate domestic production, refining, and mapping critical mineral deposits; streamline permitting and construction of energy infrastructure; and secure uninterrupted supplies in case of shortages. The orders also roll back environmental regulations and call for eliminating EV incentives enacted under the IRA, shifting policy emphasis back toward gasoline-powered vehicles. By prioritizing exclusively U.S. production over a shared North American supply chain, these measures risk undermining Quebec’s ambition to serve as a regional hub for critical minerals and EV batteries, possibly deterring foreign investors who had looked to the province as their gateway to the U.S. market. Additionally, the removal of EV subsidies diminishes consumer demand for EVs, compelling numerous companies to reassess their strategies for EV battery production in Canada.

Growing FDI in Canada’s Critical Minerals

Canada relies on FDI in various sectors, especially the mining industry. Between 2000 and 2020, FDI in the mining industry in Canada increased by more than 600%, almost three times more than the average increase in FDI for all other industries. In Quebec, the share of FDI in the mining sector increased from less than 12 per cent of the total investment in exploration and development work in 2022 to over 30 per cent in 2023.

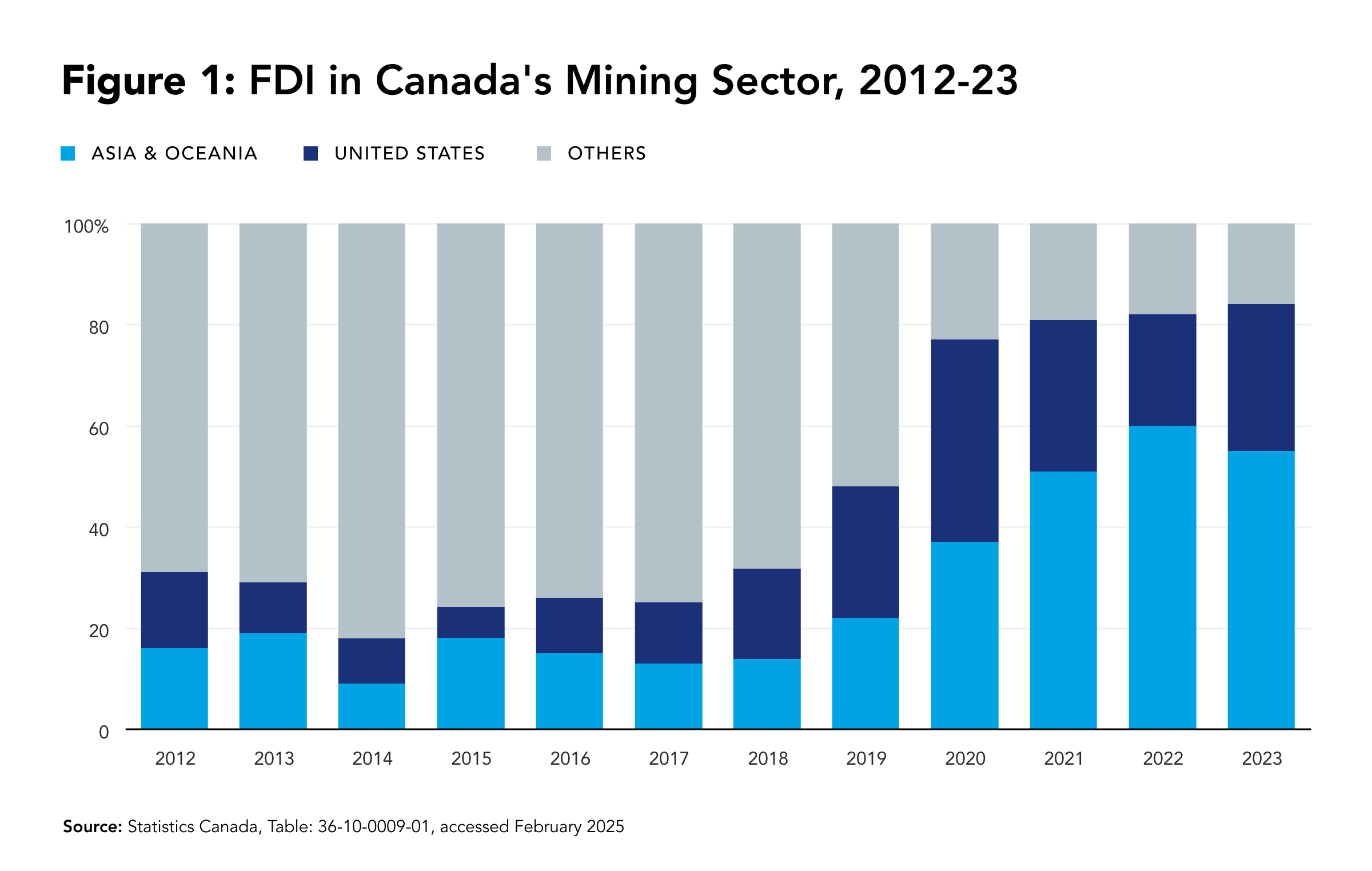

Although the U.S. remains an important source of FDI in Canada’s mining sector, it only accounted for 29 per cent of the sector’s investment in 2023. On the other hand, FDI from the Asia Pacific region in Canada’s mining sector has increased four-fold since 2012, now accounting for 55 per cent of the country’s FDI in the mining sector. (see figure 1). The Asia Pacific Foundation of Canada’s Investment Monitor database indicates that Australia and South Korea have emerged as the largest investors in Quebec’s critical minerals extraction and EV battery production.

Quebec a Growing Producer of Critical Minerals and Lithium-ion Batteries

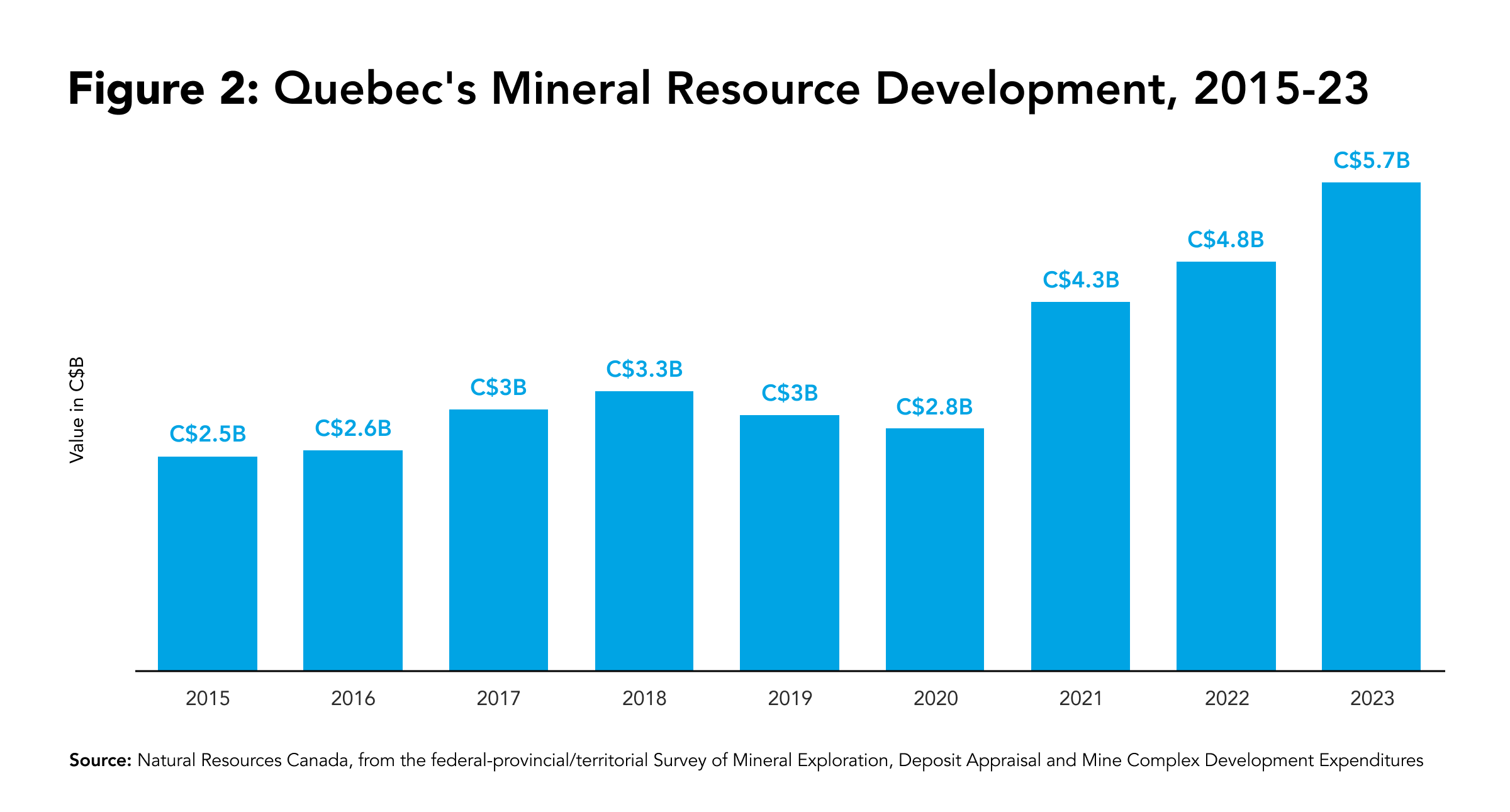

Prior to Trump’s inauguration and with the growing global demand for critical minerals, Quebec had doubled down on its critical minerals sector. Quebec’s spending on mineral exploration and deposit appraisal has been increasing since 2021 (Figure 2).

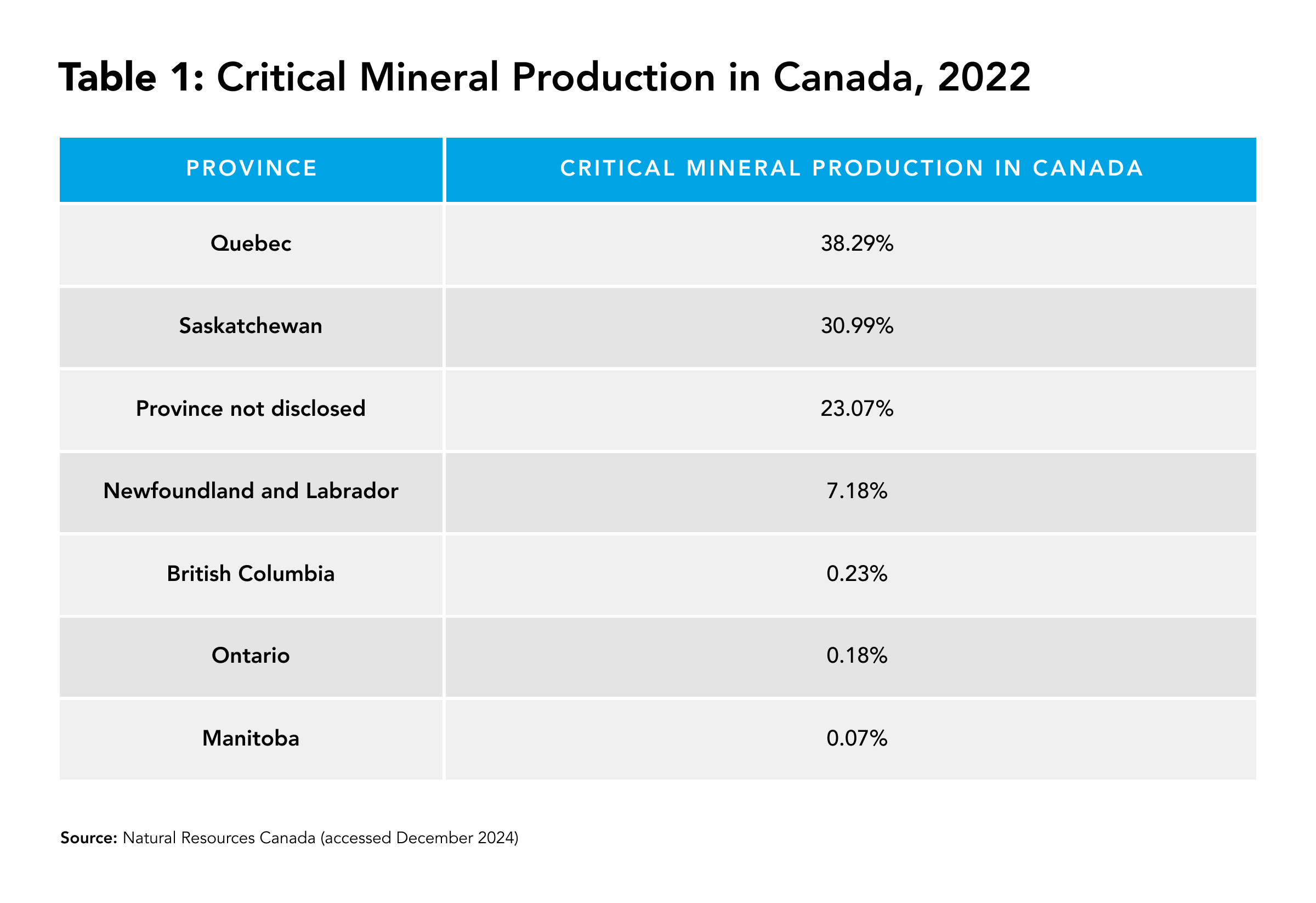

In 2022, the province accounted for around 38 per cent of critical mineral production in Canada (Table 1), and several projects have been launched in recent years to develop these minerals, especially the critical minerals used in the production of EV batteries. Lithium projects were the main beneficiaries, with several projects under development to expand Quebec’s lithium production. As the province is home to one of the world's largest lithium deposits – the Whabouchi Mine – located in the Eeyou Istchee James Bay territory (in Quebec's far north), lithium production in Quebec is bound to increase. According to Quebec government data, over 50 per cent of Canada’s lithium projects are based in the province.

Quebec’s government has also increased efforts to develop a battery manufacturing and recycling industry. It has, for example, set up an innovation hub – La Vallée de la Transition Énergétique (VTE) – that identifies research projects in the battery industry among its three research priorities. Additionally, the government has invested in several companies along the EV supply chain.

Quebec plays an important part in Canada’s EV supply chain, alongside Ontario, one of North America’s largest automotive manufacturing hubs and home to Canada’s first all-EV manufacturing facility. As the demand for EV components is expected to increase in Ontario, Quebec has positioned itself as an important supplier of critical minerals and EV batteries to support Ontario’s EV manufacturing.

Asia Pacific’s Investment in Quebec’s Critical Minerals and EV Batteries

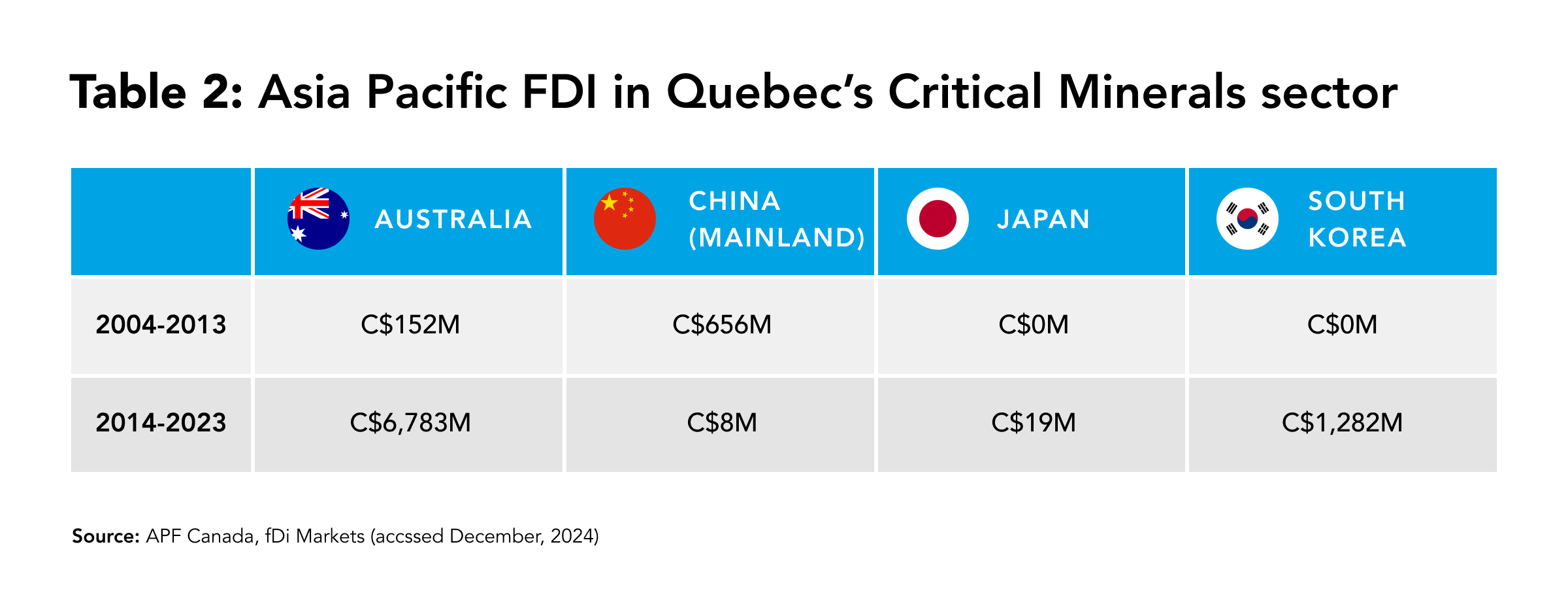

Quebec released its Indo-Pacific Strategy (IPS) in December 2021, ahead of Canada’s IPS (released in November 2022), identifying the region as Quebec’s second-largest export market with important opportunities for FDI attraction. While China’s investment in Quebec’s mining has declined since the early 2010s, Australia and South Korea emerged in the 2020s as important investors in Quebec’s critical minerals sector (Table 2).

Australia

Over the last decade, Australia became Quebec’s largest Asia Pacific investor in the extraction and processing of critical minerals, bringing over C$6.7B to the province. For example, Rio Tinto – a London-Melbourne headquartered company – has been actively involved in Quebec’s critical minerals for over 70 years, starting with a titanium dioxide plant established in 1950 in Sorel-Tracy. Over the last four years, Australian companies have been actively involved in 19 lithium projects in the province, becoming the single largest source of foreign investment in Quebec’s lithium.

Australia’s engagement is critical in helping Quebec develop its lithium production capacity by providing financial capital and technological expertise. Australia’s strong presence in Quebec’s lithium extraction showcases the complementarity between Canadian and Australian geological endowments, First National engagements, and mineral permitting systems that make it easier for corporations based in Australia to invest in Canada. Australia has advanced expertise in lithium mining as the leading global lithium supplier, which it brings with its numerous investments in Canada. Furthermore, Australia, like Canada, closely collaborates with Indigenous Peoples in the extractive sector and integrates ESG standards in the evaluation of critical mineral projects. In March 2024, the two countries released a Joint Statement on Cooperation on Critical Mineralsemphasizing their “like-minded approach to the development of global critical mineral supply chains.”

With the IRA being reconsidered under the Trump administration and a 10 per cent proposed tariff on critical minerals, Canada’s lithium exports to the U.S. may become more expensive, increasing the imperative for diversification. Despite the grim outlook for the North American lithium market, Rio Tinto completed an acquisition of the U.S.-based Arcadium Lithium, which has a lithium asset in Quebec, in March 2025. This follows a general sentiment by Canada’s critical miners, who are planning to diversify exports to markets with high demand for critical minerals. Furthermore, investments in critical minerals have longer time horizons than Trump’s policies, as it takes several years to get the lithium projects operational, making it less likely that companies will abandon these projects in response to tariffs and policy changes imposed by the Trump administration.

South Korea

South Korea is an important partner for Quebec in critical mineral processing. In 2023, South Korea’s Solus Advanced Materials, operating as Volta Energy Solutions Canada, invested C$750M to purchase a copper foil factory in Quebec. Copper foil is key for lithium-ion battery cells. Volta’s copper foil factory is expected to start production in Granby, Quebec, by 2026, with a planned expansion in 2027. South Korea’s investments bring technological expertise and finances essential for Quebec’s EV battery manufacturing.

South Korean companies are also partnering with U.S. automotive leaders to support EV battery production in Quebec – including battery material company POSCO Future M’s collaboration with General Motors to build a cathode material plant, a key component for EV batteries, in Bécancour. Two other Korean companies, SK On and EcoPro BM, invested, along with U.S.-based Ford, to build a cathode plant in Quebec. While Ford withdrew from the project in November 2024, EcoPro BM and SK ON plan to continue working on the project. After Ford withdrew from the project and despite EcoPro’s commitment to continue working on the project, it has been reported that construction will be halted in May due to economic uncertainties and a slowdown in the EV sector. La Presse, a French-language online newspaper, linked the work stoppage to Trump’s tariff threats and the need to find new customers for the plant’s EV batteries as they will not be able to access the North American markets due to proposed tariffs.

Under the Trump administration, the integrated North American EV market comes into question. While South Korean companies have been reconsidering their EV plants in the U.S., they have also delayed some of their construction projects in Quebec. SK On and EcoProm BM indicated their commitment to work on the EV plant despite Ford’s withdrawal, despite the recent announcement of the delay in the project. To showcase continued support for Quebec’s EV manufacturing, GM Motors, which partnered with POSCO on another EV battery project in Quebec, announced that it will continue to move ahead with the EV battery facility, which is scheduled to open in 2026. Further indicating commitment to Quebec’s EV production, South Korean companies and government officials have been calling on the U.S. to make the investment environment more favourable by maintaining the IRA. By extension, a greater certainty in the investment and policy environment will make it easier for South Korean companies to continue their EV plants in Quebec.

Conclusion

The expanding partnerships between Quebec and its Asia Pacific partners have materialized in a series of large-scale investments. These investments span from Australia’s growing role in Quebec’s lithium resource projects, which will help the province expand its lithium production, to South Korea’s investment in EV battery production, which is contributing to the development of an EV battery production ecosystem in Bécancour. These projects ultimately contribute to the development of an integrated critical mineral supply chain in Quebec, bring foreign investment, contribute to local employment, and facilitate infrastructure investments in new roads and plants. To date, the emerging battery industry in Bécancour has generated C$2.5 billion in spin-offs.

The uncertainty created by the U.S. shows what could be at stake if U.S.-Canada relations are disrupted further and raises the question about sustaining the momentum for trade and investment diversification into the Indo-Pacific region. Quebec’s EV battery manufacturing sector exemplifies the delays that the tariffs and IRA uncertainty have on the investment from the Indo-Pacific. Quebec and Ontario were both planning to play a key role in the IRA, which attracted Australian and South Korean companies to enter Canada’s critical mineral and EV markets. As the future of the IRA is in question, the Canadian EV and critical mineral industries may face delays until market uncertainty declines and companies can calculate the risks associated with the new political environment. While there is an indication that some existing EV battery projects have been put on pause as next steps are determined, the 25 per cent tariff on Canadian products and 10 per cent on Canadian energy resources could jeopardize the future of investment in critical minerals and EV sectors.

Diversifying customers for Canadian critical minerals and EV batteries may help these industries regain momentum and keep the projects going despite the changes in Canada-U.S. trade relations. The federal government has announced new investments in critical minerals mining, including several lithium projects in Quebec, to offset the uncertainties related to the future inflows of FDI. As such, the U.S. tariffs offer the opportunity for Canada to double down on public-private investments with Asia Pacific partners, which have already played an important role in Quebec’s critical minerals and EV sectors. Both Australia and South Korea remain committed to Quebec’s critical mineral and EV supply chain, despite increasing uncertainty about the future of an integrated North American EV market. Canada may also leverage its regional free trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), to identify new investment partners.

• Edited by Vina Nadjibulla, Vice-President Research & Strategy, APF Canada